Commodity Market Review: OPEC Relieves Fears Of A Crude Oil Oversupply

Summary:

- Crude Oil Futures (CME_CL1) are on the up with a 3.05% rise.

- The risks of a crude oil oversupply are less likely.

- Platinum Continues to See A Remarkable Rise.

- VanEck Vectors Gold Miners ETF (GDX) sees a 10.83% increase.

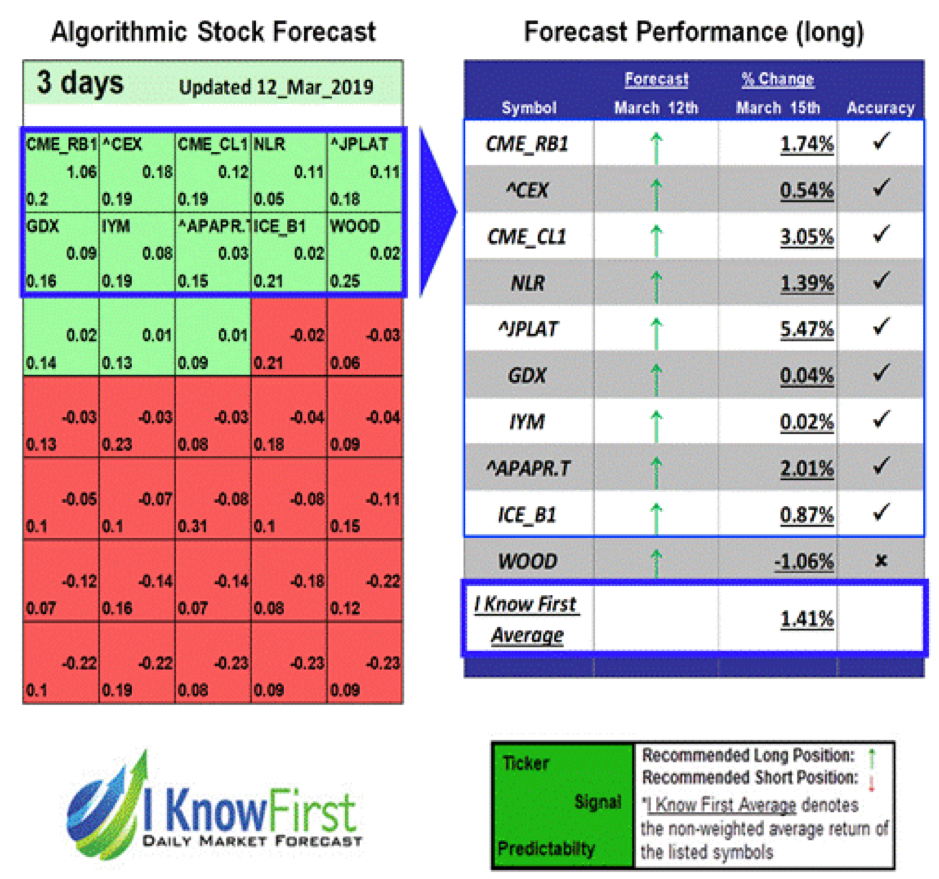

Crude Oil Futures (CME_CL1) are on the up with a 3.05% rise over the past three days from 12th to the 15th March in good agreement with I Know First Forecast. Following recent reports that the risks of a crude oil oversupply are less likely, and the recent OPEC activity suggests that the market will take a positive turn for crude oil investments. In a recent statement Saudia Arabia’s energy minister Khalid al-Falih stated: “I am obviously optimistic that implementation of our OPEC+ agreement will improve, it’s already strong by historical standards.” The OPEC production review will take place on 17-18 April and judging by the market reaction it seems to be expecting a positive outcome from this summit.

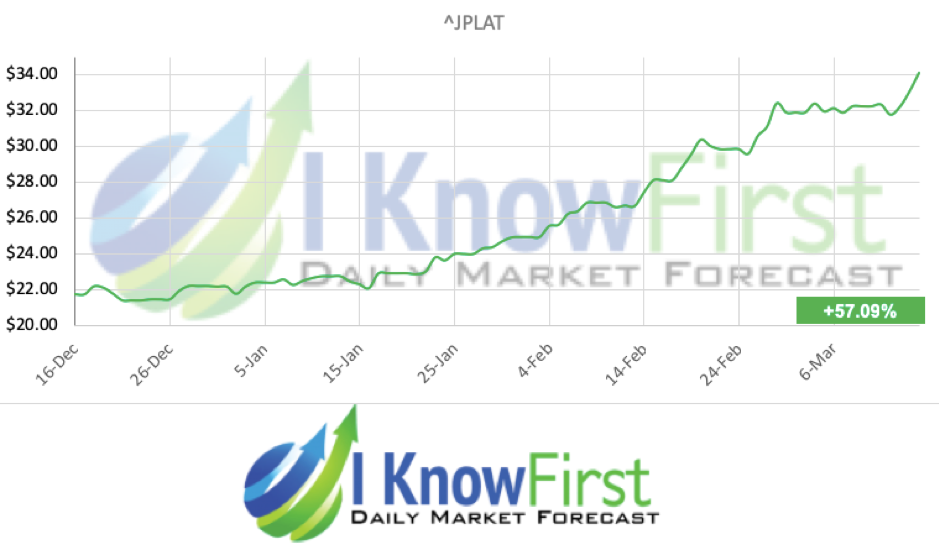

Platinum Continues to See A Remarkable Rise

Platinum (^JPLAT) returns 57.09% over the three-month period from 16th December to 15th March in accordance with the I Know First forecast. Platinum has been providing the highest returns in the commodity market over the past three months. The increased global demand for reduced carbon emissions has led to car manufacturers using this sought-after precious metal in car exhausts as a catalytic convertor.

VanEck Vectors Gold Miners ETF (GDX) sees a 10.83% increase over the same three-month period from 16th December to 15th March. With big changes in the gold mining industry largely due to Barrick Gold’s acquisition of Rangold the gold mining market has seen increased returns with a stronger overall mining industry.

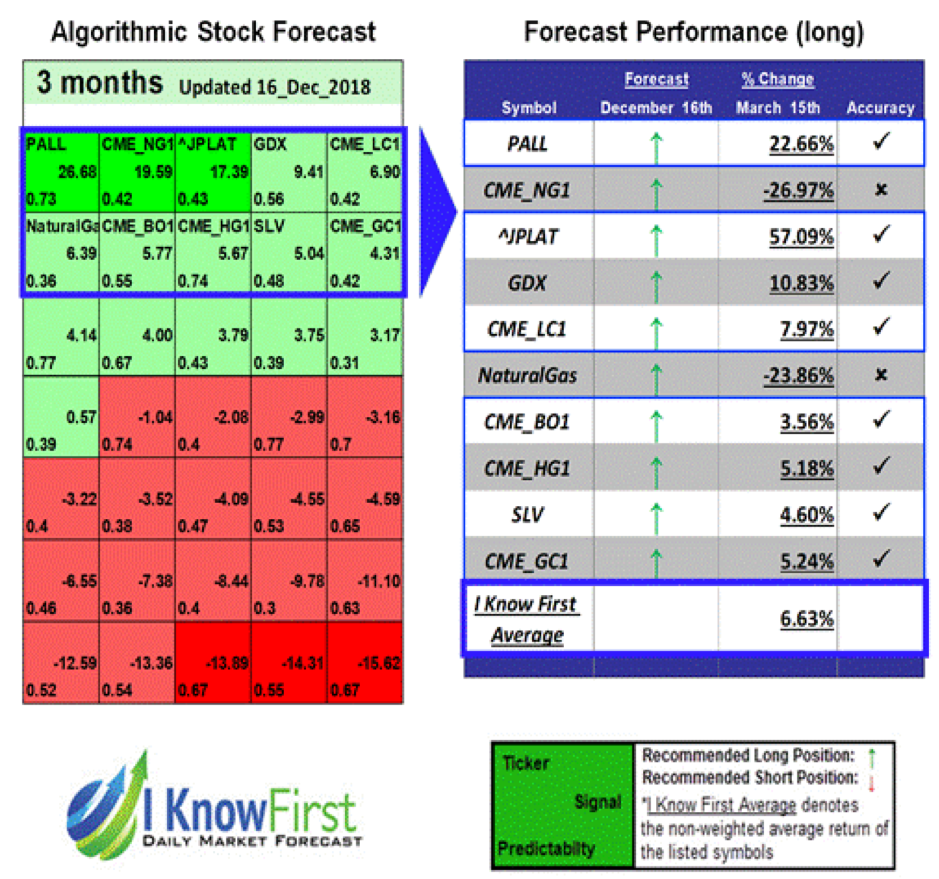

I Know First Successful Commodities Forecast

On the 16th December and the 12th March, I Know First algorithm issued bullish predictions for commodities for a 90-day & 3-day time horizon respectively. The predictions include Platinum (^JPLAT), Crude Oil (CME_CL1) and Gold Mining (GDX). Over the respective trading periods, Crude Oil rose by 3.05%, Platinum rose by 57.09% and Gold Mining by 10.83%.

These bullish Gasoline and Platinum forecasts were sent to the current I Know First subscribers on the 4th February and the 10th February respectively.

To learn how you can become a subscriber today, click here.

Please note-for trading decisions use the most recent forecast.