Commodities Market Review: Big 1-Week Gain of Grain Contracts from Ukraine’s Export Limitation

Commodities Market Review

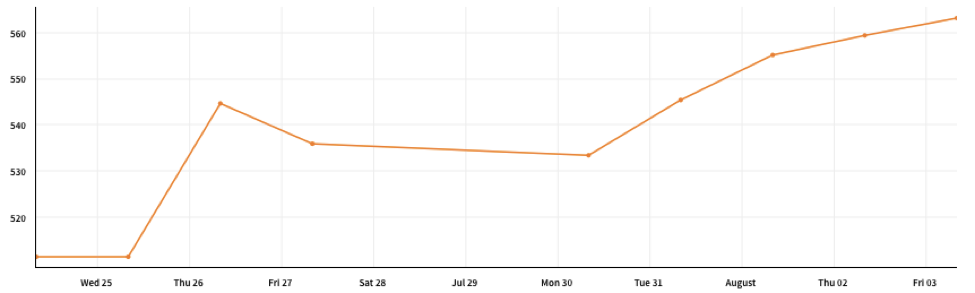

During the past week, grain became the biggest winner once again. Last Thursday, wheat price rallied to a three-year high of $5.93 per bushel. Later on Friday, wheat price further hold the highest level and hence achieved a weekly gain of about 7%. Grain market in general got firmed amid worries about weather-reduced crop yield and speculation that Ukraine would restrict exports. However, soybean futures drifted lower last Friday on concerns about a heating trade war between US and China.

Exhibit: CME_W1 (Wheat) Future Price

(Source: Quandl)

Weather Problems Remain as the Primary Grain Price Pusher

As discussed in our last week’s commodity market review, global crops from several largest suppliers are being threatened by continuous unusual weather conditions this year. Searing heat, excess rain in the Black Sea region and severe dryness would drag EU’s wheat output to a second-lowest level in a decade, while lead Russia’s yield to fall for the first time in six years. At the same time, Australia, as another key wheat supplier, would also be a major victim of dry weather. As a whole, wheat would have the smallest world total output in five years and make global stocks shrink. Fears of further crop damage from the weather problems became the primary pusher of grain price’s soar.

Backed by Ukraine’s Possible Export Limitation

The spike in wheat price is secondly contributed to a statement on Facebook saying that Ukraine, the world’s fifth-biggest shipper, is planning to limit export of milling wheat since European yield is harmed by drought. As crops are cut in other major exporters, Ukrainian grain is becoming more attractive for global buyers. Although the Agriculture Ministry later denied the plan and clarified that it will discuss projected shipping volumes with grain traders instead of issuing formal strict limits, wheat price held at roughly the same level. According to the announcement from the ministry, it tends to sign a memorandum with traders regarding limits for the 2018-19 season.

(Source: Wikimedia Commons)

“We plan to set limits for milling-wheat export for the mid-term period in the beginning of the marketing season,” the ministry said. “Securing the domestic market and the stability of prices for key food are an absolute priority.” Regardless of the enforcing approach, the final effect of restricting grain sales would be similar. As a result, benchmark wheat futures in Chicago Board of Trade jumped as much as 6.2%.

Souring U.S. – China Relations

Market worries about the escalation of trade war is putting up resistance for the rising grain price, especially the soybean price. Last Thursday, regarding the Trump Administration’s new proposal of a higher 25% tariff on $200 billion Chinese imports, China urged US to “calm down” and “return to reason”. Later that Friday, China proposed more retaliatory tariffs on $60 billion worth of US goods. This proposal from the world’s largest soy importer means potential big demand slide for the American soybean. It also casts doubt on the possibilities of talks with Washington to solve their trade friction. Therefore investors are concerned that the trade war with China is going to last for some time. Despite such worries, soybean price still got strong support from wheat price last week.

(Source: downtoearth.org.in)

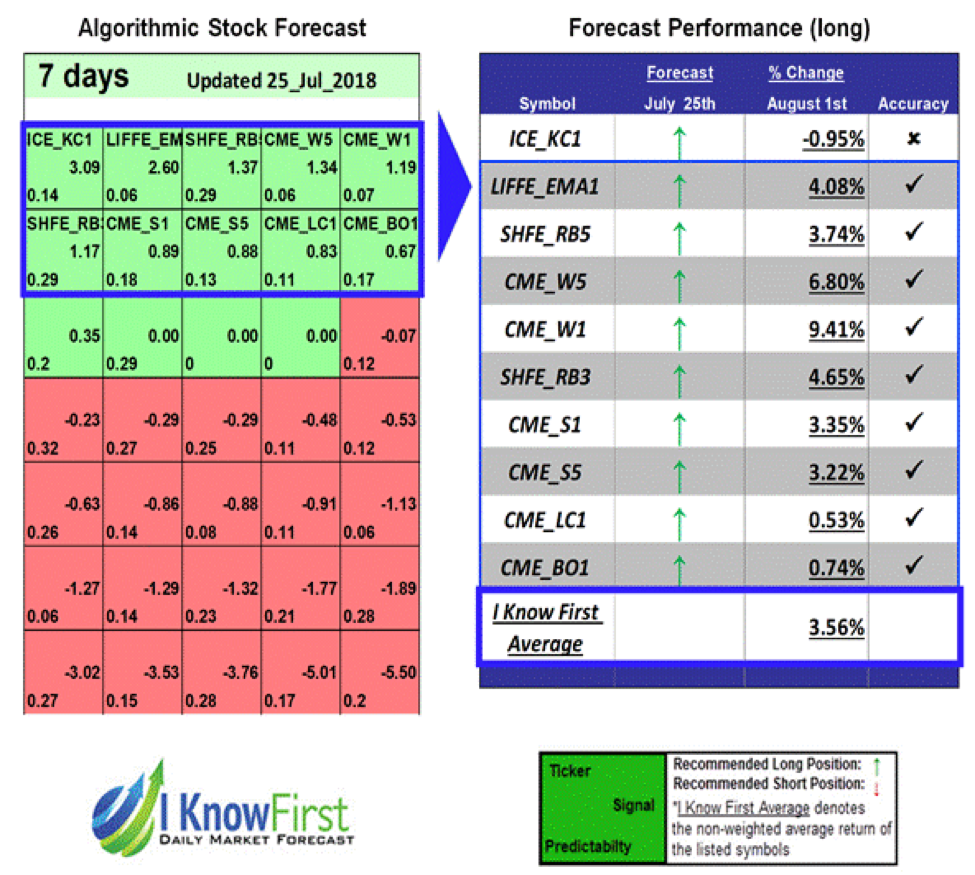

I Know First’s Successful Forecast

On July 25, I Know First algorithm issued bullish predictions for commodities for a 7-day horizon. The predictions include CME_W1, CME_W5, both continuous wheat futures contracts and SHFE_RB3, a rebar future contract on Shanghai Future Exchange. Over the 7-day trading period from July 25 to August 1, CME_W1, CME_W5 raised by 9.41%, 6.80% respectively and SHFE_RB3 increased by 4.65%.

This bullish gold forecast was sent to the current I Know First Subscribers on July 25, 2018.

How to interpret this diagram

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top commodities picks.