Commodities Market Review: A “New Phase” of EU Relations Prompted a Grains Revival

Commodities market review

Grain market experienced a volatile week from July 23 to July 27 due to some heavy-handed external influences. Three of the main grain products, wheat, soybean and corn all greatly rallied over the week, caused by a combining effect of global weather concerns and the announcement of $12 billion aid to American farmers and US collaboration talks with EU.

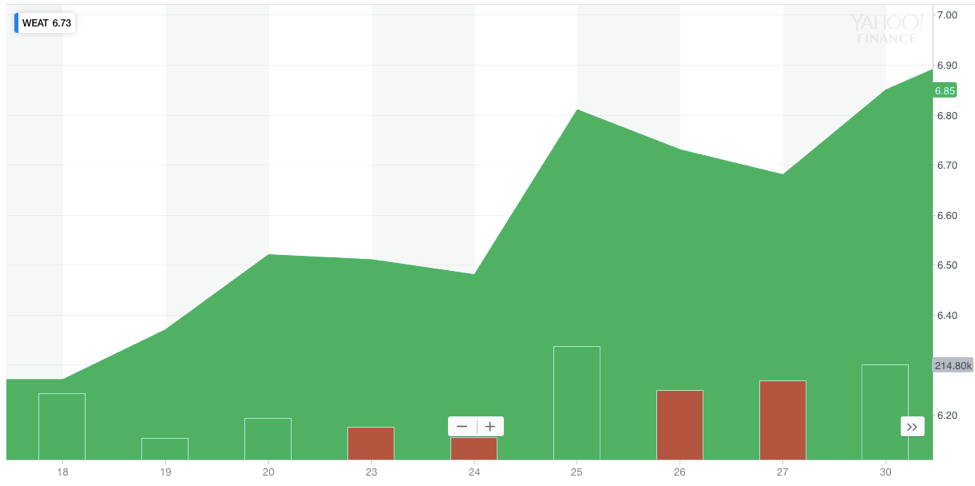

Exhibit: WEAT (Teucrium Wheat ETF) Price

(Source: Yahoo Finance)

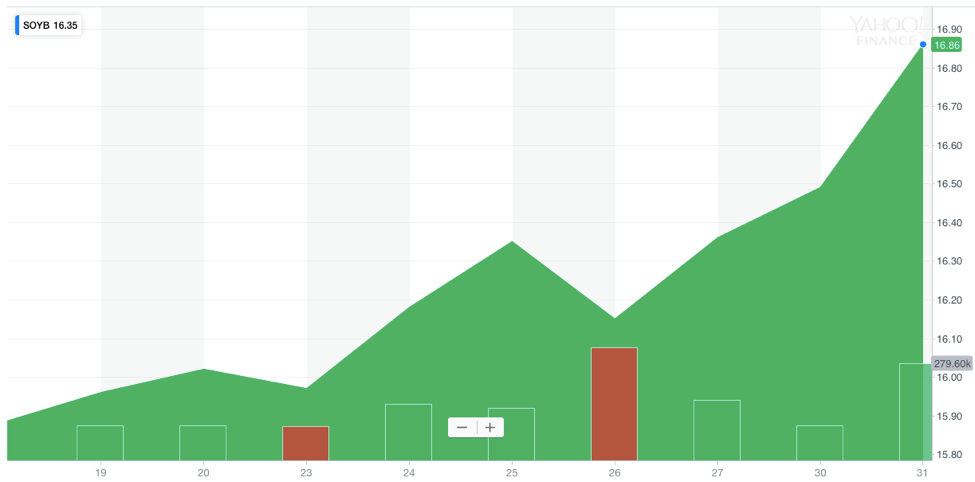

Exhibit: SOYB (Teucrium Soybean ETF) Price

(Source: Yahoo Finance)

World Weather Continues to Support American Grains

As mentioned in our last weekly commodities market review, the continuous world weather worries in major growing areas kept pushing grain prices higher. Specifically for wheat, according to European Union’s (EU) estimation, world wheat supply is going to cut 8.5% to 130 million metric tons, because of the excess rain in Russia and dry conditions in Australia. Furthermore, the annual crop tour of fields in North Dakota, the top US hard red spring wheat grower, reported below-average crop yield potential in both southern half of North Dakota and adjacent areas of South Dakota, hurt by hot weather conditions. Thereafter for US wheat market, the increase in demand as well as supply shortage led to double-digit gains in wheat futures overnight last week.

(Source: Pinterest)

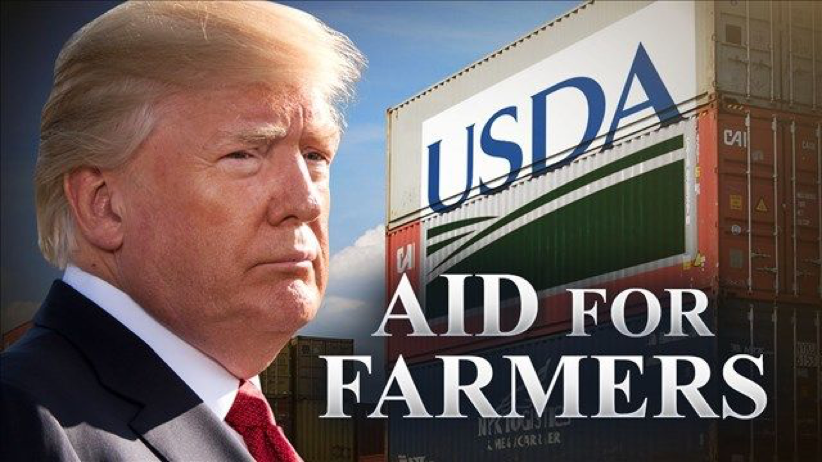

Financial Aid Program Aims at Healing Farmers

Despite weather problems, the market turmoil was also triggered by the farm aid from the US government. Earlier last week, the administration of US President Trump signaled its long-term commitment to tariffs. At the same time last Tuesday, it announced $12 billion’s aid package, a Great Depression-era program, to compensate US farmers for losses incurred from the trade war. Under the program, producers will be compensated by either direct payments or surplus commodities purchase for distribution to food banks and other nutrition programs.

(Source: AgWeb)

There are some controversies and concerns regarding the aid since farmers would always want a free and fair trade policy and hence a stable long-term demand rather than a short-term financial aid. However, farmers are benefiting from this new policy after all because the extent of hurt they get from the trade war could be largely reduced, even if in a short term, and so that the cash market could gain more time to develop more. Therefore, after a month’s depression due to the trade tension, the grain market finally saw a big recover thanks to a positive market mood shift.

A Potential Cease-fire with EU

On the other hand, the rally of grain market also came from recent talks and smoothed trading relations between the US and EU. Previously with the tariff added to Chinese import goods, demand for US grains, especially for soybeans, was substantially damaged because of a huge loss of Chinese customers. Such price cap in grain market got raised since President Trump and EU leaders completed a more collaborative conversation instead of slapping more tariffs and beginning another trade war. Last week, they reached an agreement on more open trade and has moved closer to a fair deal. More specifically, EU countries agreed to buy more soybeans from the US this year, pushing canola price higher. Since soybean prices are normally guiding the price movements of other grains, there are similar effects on wheat and corn prices as well.

(Source: treasuryandrisk.com)

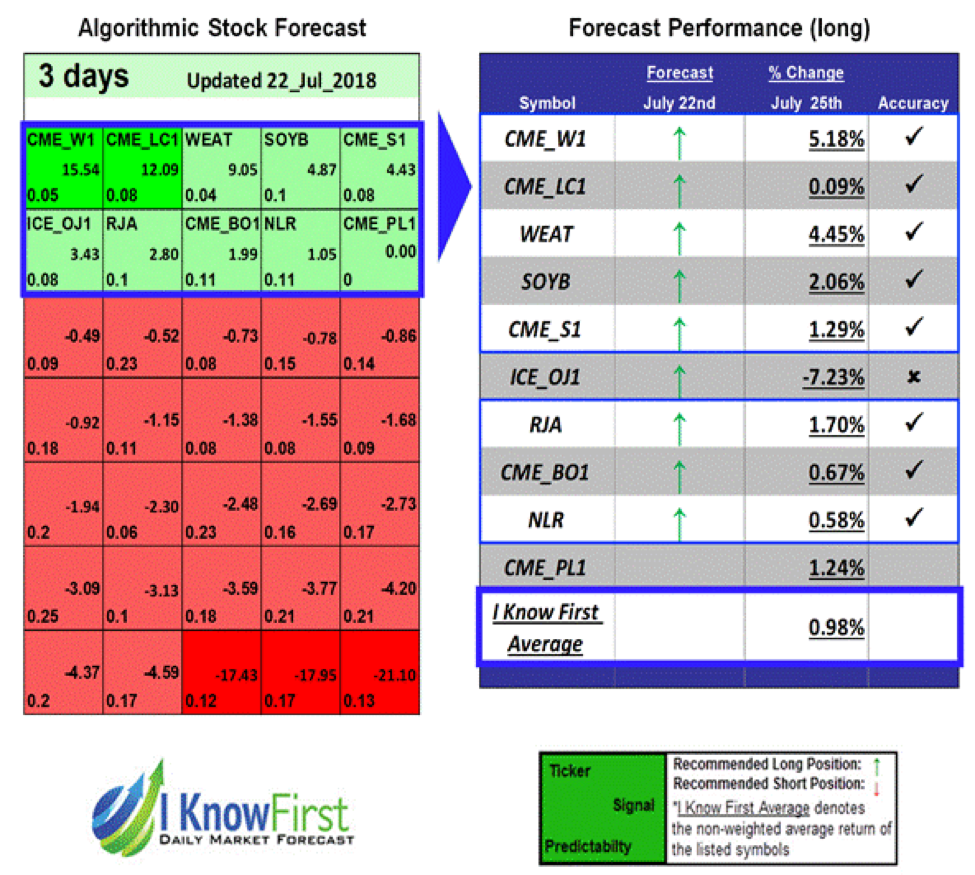

I Know First’s Successful Forecast

On July 22, I Know First algorithm issued bullish predictions for commodities for a 3-day horizon. The predictions include CME_W1, a continuous wheat futures contract, WEAT, Teucrium Wheat ETF and SOYB, Teucrium Soybean ETF. Over the 3-day trading period from July 22 to July 25, CME_W1 raised by 5.18%, WEAT and SOYB increased by 4.45% and 2.06% respectively.

This bullish gold forecast was sent to the current I Know First Subscribers on July 22, 2018.

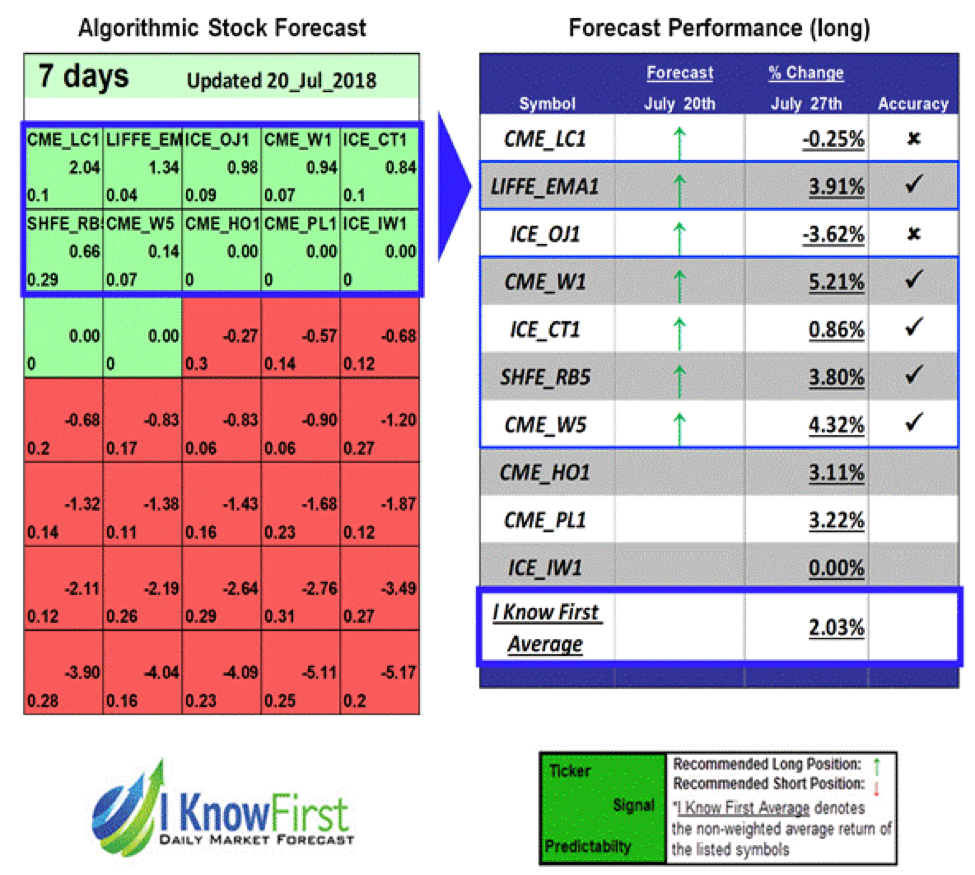

On July 20, I Know First algorithm issued bullish predictions for commodities for a 7-day horizon. The predictions include CME_W1 and CME_W5, both representing Wheat Futures Contract, and LIFFE_EMA1, a continuous corn futures contract. Over the 7-day trading period from July 20 to July 27, CME_W1 and CME_W5 rose by 5.21% and 4.32%, and LIFFE_EMA1 increased by 3.91%.

This bullish commodities forecast was sent to the current I Know First Subscribers on July 20, 2018.

How to interpret this diagram

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top commodities picks.