Commodities Market Review: Soft Commodities was Fully Backed Up until Trump’s New Tariff Policy

Cotton Price Refreshed its 6-Year High

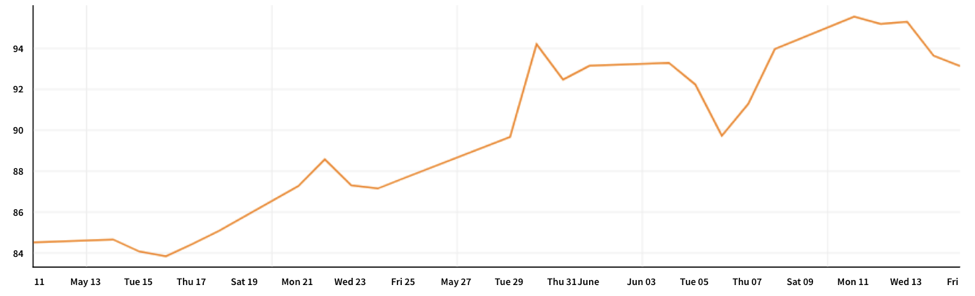

The U.S. cotton market has remained stable since its spike in 2011, when China executed its cotton reserving and fiber hording plan. It is believed that U.S. cotton demand and price were artificially kept low because there are always worries that China would unexpectedly unleash its cotton stockpile, about half of the global storage. However, U.S. cotton price finally showed a revival in recent days. The ICE July cotton futures closed at 95.21 cents a pound on Tuesday, June 12, the highest level for a front-month future contract in the last 6 years.

(Source: Quandl)

The revival could be attributed to multiple factors, with an emphasis on the worries about insufficient rain in the cotton-growing areas and the newly issued import quotas from China.

Backed by Weather-Related Worries

Severe drought kept hitting parts of the Brazos Valley in Texas, the key cotton-growing regions in the U.S. It was reported by the weather service that Brazos County only received 14 inches of rain through June 14 this year, about 2/3 of the amount in the same period last year. Besides, the exceptional amount of rain and potential flash floods caused by the tropical storm Alberto added to the worries about lack of cotton supply this harvest season.

(Source: UT News)

Another Catalyst – China’s Extra Import Quotas

China has just shifted out from its fiber reserve strategy and moved back to the global cotton market. Signals were shown by the reducing reserve levels over the past few years and the recently issued report by China’s Ministry of Agriculture and Rural Affairs, stating that there is an expectation of rising cotton imports following insufficient domestic supply of high quality lint. After that, the increased demand of imported cotton was further proved by China’s newly issuance of an extra 800,000 tons of import quotas for private firms. Furthermore, it is shown by U.S. Department of Agriculture data that China has purchased futures contracts for 361,000 bales of cotton, a peaked amount since 1998, equivalent to 400 million T-shirts’ production. The surging demand significantly drove up the cotton price.

(Source: PorterBriggs)

Turning point – the Trade War

Just as everyone thought the trade war was fading away as some agreements were reached between countries, Donald Trump surprised the public again by imposing 25 percent tariffs on another $50 billion strategically important imported goods from China last Friday. China immediately struck back the next day by setting an equivalent 25 percent tariffs on 695 U.S. goods worth $50 billion. As a defense, China requested U.S. to pay the penalty on the products they have long been relying on. For U.S., the agricultural sector suffered the most from the trade war since the tariffs cover all types of agricultural products, including soy, corn, wheat, cotton, beef, pork, fish, vegetables, etc. As a direct result, cotton price slipped 2.36% and soy price decreased by 2% after the news was announced.

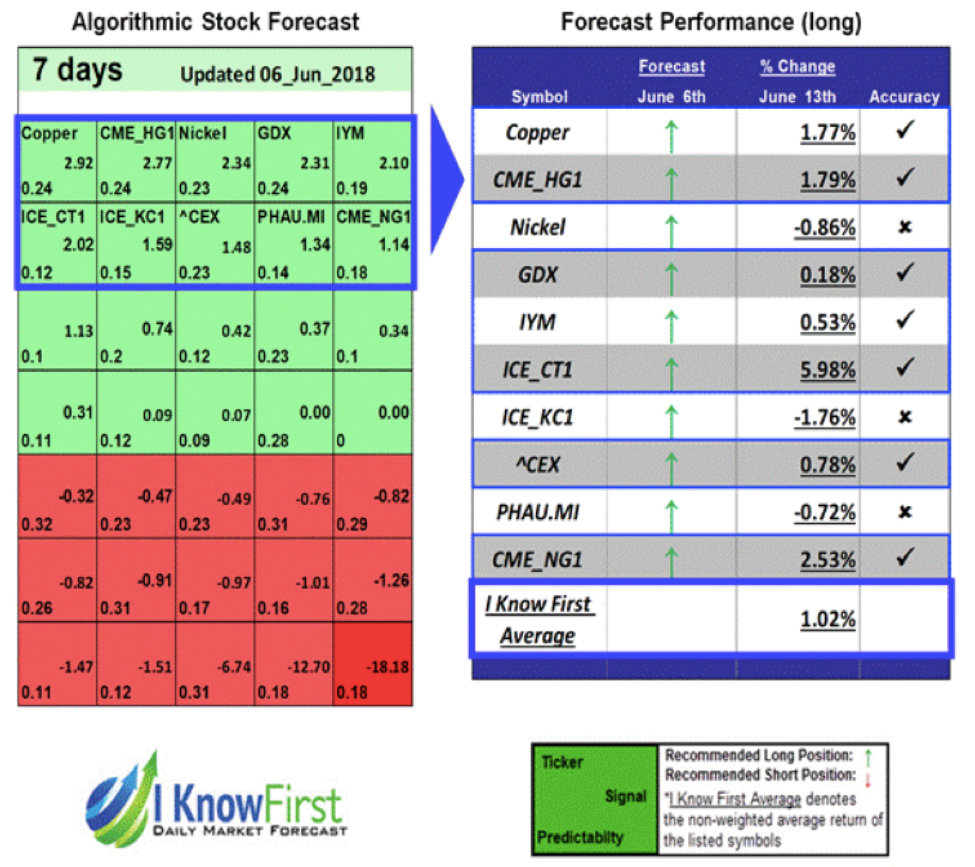

I Know First’s Successful Forecast

On June 6, I Know First algorithm issued a bullish forecast on ICE_CT1, a cotton future contract. Over the 7-day trading period from June 6 to June 13, ICE_CT1 gained the highest returns of 5.98%.

This bullish commodities forecast was sent to the current I Know First Subscribers on June 6, 2018.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top commodities picks.