Commodities Market Review: Sugars Rally Doesn’t seem Sustainable

Commodities Market Review: Sugars Rally Doesn’t seem Sustainable

Best Weekly Gains since 2008

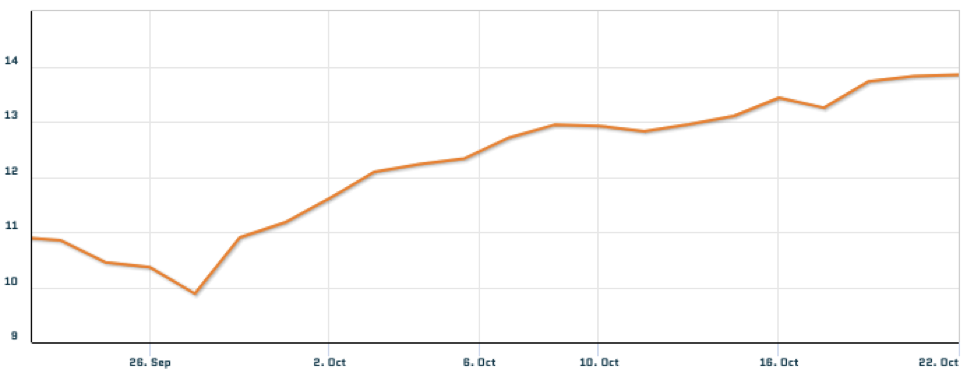

In late September Sugar prices were as low as $10, however currently the price has increased to $13.75. This sudden increase is mostly due to a strong currency in the top sugar producer, Brazil. While sugar might have had a good month, it is still one of the worst performers of the year, and many analysts don’t see it going much higher. The main reason for the cautious outlook is due to India. India is the number two producer of sugar, and are expected to boost their exports, and due to this and the lower demand for sugar from North America, there will likely be another year of surplus.

Source: publicdomainpictures.net

Source: publicdomainpictures.net

Since reaching the bottom, raw sugar prices witnessed a slight recovery due to the bailout package implemented by the Cabinet Committee of Economic Affairs (CCEA). In order to help sugar mills saddled with excessive sweetener stock to divert the cane juice for ethanol production, a massive raise in the price of ethanol produced directly from sugarcane juice was announced. The procurement price of ethanol derived from 100% sugarcane juice hiked by 20% up to Rs 160.90 (Details can be found here.) The new policy is expected to absorb some proportion of the oversupply in the global sugar market and hence remove the pressure on prices in the short term.

(Source: quandl.com)

Excess Amount of Sugar

This season world supply of sugar outpaced demand by 5.8 million metric tons, following last year’s massive surplus of 11.8 million tons. The oversupply is mostly due to a large production in countries like India and Thailand.

Sugar Oversupply

Brazil

The amount of sugar produced in Brazil has seen a significant decline in the past few years, mostly since the higher than expected temperatures and humidity have hurt crops. Another reason the amount of sugar produced in Brazil is declining is that many mills have decided instead of making sugar they will make ethanol, which is more profitable. Because of the facts stated above Brazil, main growth region will reduce output by 25% according to Industry Group Unica

Indian Impact

Going forward India is expected to record another record harvest, without India the market would most likely be in deficit. In order to help struggling mills and cut domestic glut, India will allow 5 million tons to be exported this season, which is an unprecedented amount.

Long-term Sugar Market

The low prices of sugar may end up reducing the appeal of planting sugar and might make people decide to plant something more profitable. However currently many EU growers are tied up in long-term supply deals, but once those contracts start expiring there probably be a large number of people switching what they grow.

Natural Gas

Source: new.torange.biz

Currently natural gas makes up about 39% of domestic power generation, and likely still growing. The reason it will still grow it is more prolific and economical than coal, also more and more coal plants are retiring and combined-cycle gas turbines (CCGTs) are being put in service. This year’s winter is supposed to be 1.5% warmer than last year’s. while the warmer weather might decrease the demand for natural gas the lessening of demand will be counteracted by New gas-fired plants.

(Source: quandl.com)

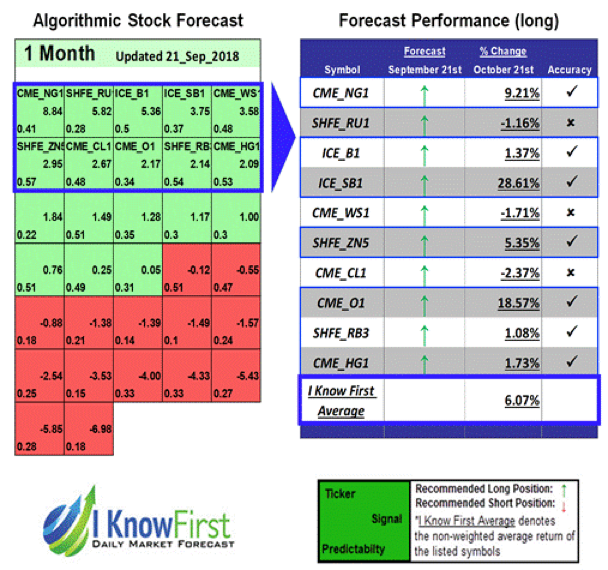

I Know First’s Successful Forecast

Sugar

On September 21, 2018 I Know First algorithm issued bullish predictions for commodities for a 1-month time horizon. The predictions include ICE_SB1, a continuous sugar futures contract. Over the 1-month trading period from September 21 to October 21, ICE_SB1 raised by 28.61%.

Natural Gas

(10/08/2018 – 10/22/2018)

On October 08, 2018 I Know First algorithm issued bullish predictions for commodities for a 14-day time horizon. The predictions include Natural Gas, a continuous sugar futures contract. Over the 14-day trading period from October 08 to October 22, Natural Gas raised by 1.40%.

This bullish commodity forecast was sent to the current I Know First Subscribers on August 26, 2018.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top commodities picks.