Commodities Market Review: Sugar’s Bottom-up after Global Glut

Sugar Slumped to a Decade Low due to Supply Surplus

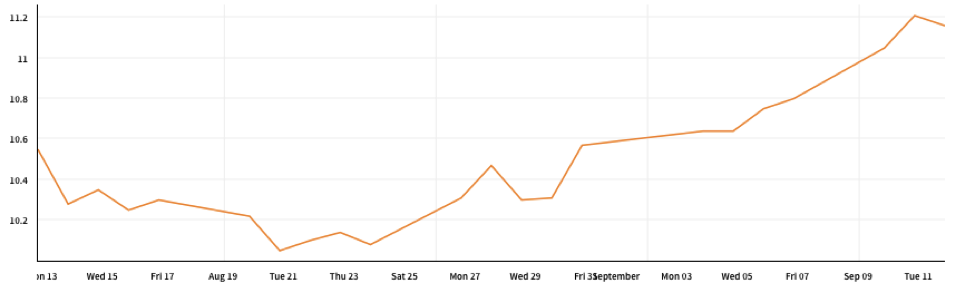

The Sugar Price Index averaged 157.3 points in August, 5.4% lower than the July average. On August 22, raw sugar prices in New York sank to 9.91 US cents, the lowest level in a decade because of a severe global supply glut, great fund short positions as well as the continued currency depreciation in the largest sugar exporters, Brazil and India.

Exhibit: Price of ICE_SB1

(Source: quandl.com)

In past several months, both India and Pakistan pushed forward the implementation of price subsidy schemes to boost local sugar production. As India is expected to surpass Brazil and become the world’s top 1 sweetener provider, a subsidy of about $0.76 per tonne of cane crushed by mills and sold was approved in May. According to analysts, India produced 32.3 million tonnes sugar last year and is estimated to increase by 10 percent up to 33-35 million tonnes this year. On the other hand, after experiencing several years’ production growth, Pakistan quadrupled the total amount of sugar eligible for export subsidies up to 2 million tonnes to decrease the domestic oversupply. Both of the policies are adding to the existing sugar surplus in the global market, leading to a greater uncertainty of the price sustainability.

Sugar Recovery Led by the Bailout Package

Since reaching the bottom, raw sugar prices witnessed a slight recovery due to the bailout package implemented by the Cabinet Committee of Economic Affairs (CCEA). In order to help sugar mills saddled with excessive sweetener stock to divert the cane juice for ethanol production, a massive raise in the price of ethanol produced directly from sugarcane juice was announced. The procurement price of ethanol derived from 100% sugarcane juice hiked by 25% up to Rs 59.13 per litre. (Details can be found here.) The new policy is expected to absorb some proportion of the oversupply in the global sugar market and hence remove the pressure on prices in the short term.

(Source: ChiniMandi)

Bullion Rallied upon New Round of Trade Talks

Gold future price rebounded to the highest closing price in two weeks after dipping into a 20-month low in mid-August. The major contributor is the pullback of USD due to a potential new round of trade negotiations that the U.S. is reaching out to China for and weak latest U.S. economic data released on Wednesday.

Since the breakout of trade war, safe-haven seekers have been heading towards the greenback, rather than the yellow metal. Therefore, there has been worries that there would be slack in demand for the metal as the trading relations get more tightened, providing support for the recent gold price. Moreover, it’s generally believed that the imposition of raised tariffs on more Chinese and American goods will have negative long-term impact on the global economic environment.

Exhibit: Gold Price

(Source: tradingview.com)

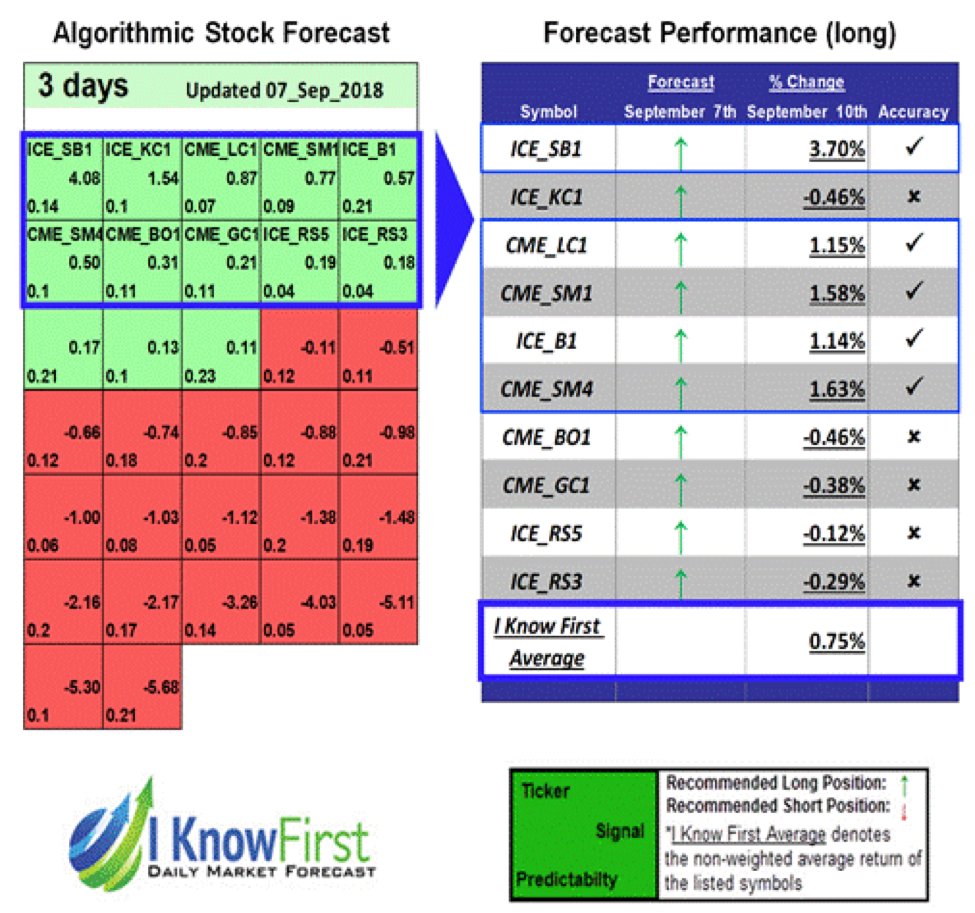

I Know First’s Successful Forecast

On September 7th, I Know First algorithm issued bullish predictions for commodities for a 3-day horizon. The predictions include ICE_SB1, a continuous sugar futures contract. Over the 3-day trading period from September 7 to September 10, ICE_SB1 raised by 3.70%.

This bullish commodity forecast was sent to the current I Know First Subscribers on September 7, 2018.

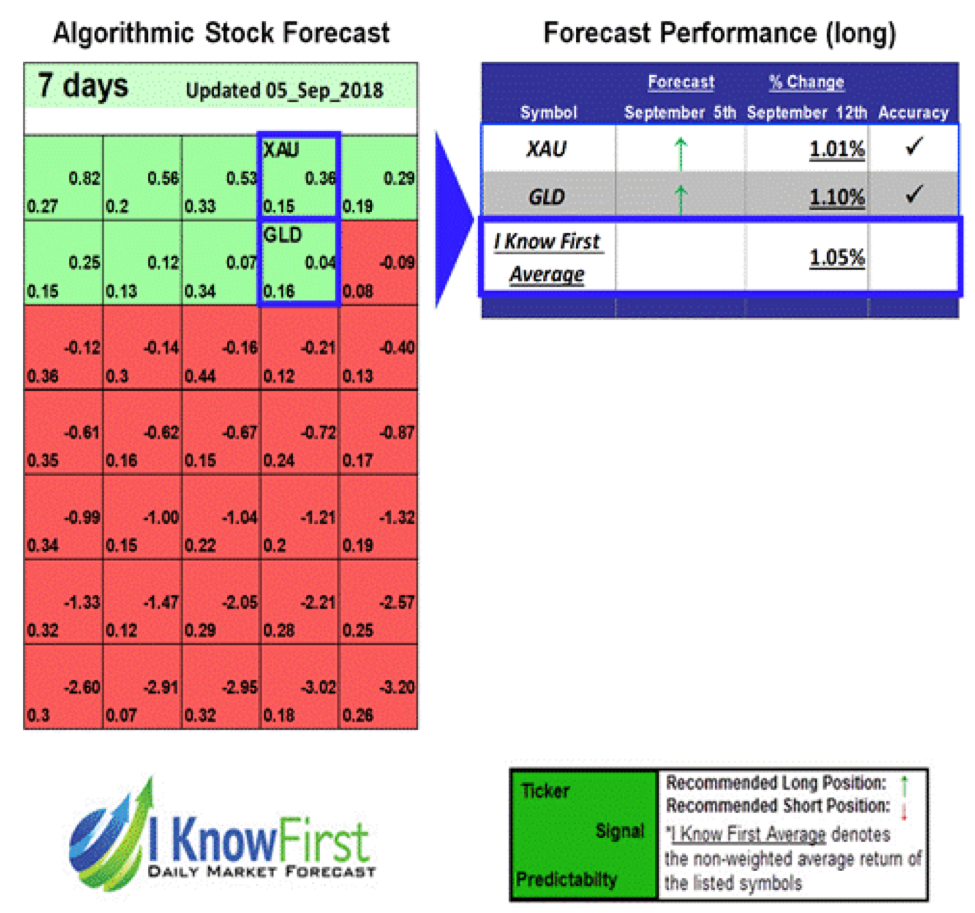

On September 5th, I Know First algorithm issued bullish predictions for the precious metals for a 7-day horizon. The predictions include GLD, a gold ETF and XAU, a physical gold commodity. Over the 7-day trading period from September 5 to September 12, GLD and XAU raised by 1.10% and 1.01% respectively.

This bullish commodity forecast was sent to the current I Know First Subscribers on September 5, 2018.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top commodities picks.