Gold Prediction For 2017

![]() The article was written by Jacob Saphir, a Financial Analyst at I Know First.

The article was written by Jacob Saphir, a Financial Analyst at I Know First.

Gold Prediction For 2017

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.” Alan Greenspan

Summary:

- Economic View: Depreciating currency in the British pound and Russian Ruble prompting gold purchase

- Political Factor: Federal Reserve Interest Rate, Negative Correlation between Dollar and Gold, and 2016 US Election

- Bank Forecast: Positive Outlook in Gold

Background:

Gold is more than a symbol of wealth. Besides jewelry and currency, gold is used in electronics and medical applications. Gold is one of the most circulated commodities in the world. Although gold has been replaced by paper money, gold is used to hedge against paper currency, inflation, political uncertainty, or diversification in an investment portfolio. The constant question asked is, what will the price of gold be in the future? Perhaps the best indication is to follow the central banks’ activity. Are they a buyer or a seller? As we review economic and political events taking place, the banks are giving a bullish forecast for the year 2017.

Economic View:

Gold has been viewed as a good hedge tool to prepare for the uncertainty. Earlier this year, we saw in a surprise move called Brexit, the United Kingdom voted to leave the E.U. Since then, the pound currency is continuing to devalue by over 20%. One has to ask themselves, how much more will the pound devalue? With the pound declining in devalue, the central bank of the United Kingdom, Bank of England, will start increasing its gold reserve by purchasing gold in the future. This will contribute to increasing the price of gold as the 5th largest economy based in GDP will look to hedge against its devaluing currency. Without hedging, the country and its people could start seeing its purchasing power decrease.

The United Kingdom is not the only one influencing the supply and demand of the world’s trade in gold. Russia has been one of the largest buyers of gold. Since the start of the year, Russia has been adding at least 14 tons of gold per month on average. What is causing Russia to increase its gold reserves? Perhaps the explanation is from 2 factors developed in the year 2014. Russia is heavily dependent on the price of oil. Oil and natural gas accounted for 68% of revenue trade in the year 2013. As a result of the price of oil decreasing by over 50% in the year 2014, the ruble began to decrease. Another factor was the result of annexing the Crimea region during Ukraine’s unrest. This resulted in the international community to sanction trade with Russia. This contributed to devalue the ruble and inflation rising. By the end of the year 2014, the ruble currency decreased by 50%. Drastic results requires drastic measures. The central bank of Russia announced within 5 years, the country will have $500 billion in gold reserve. Since then, Russia has increased has risen to be the sixth largest holder of gold reserves. China too is following Russia’s example by purchasing gold. As of May 2016, the country has 1,797.5 tons of gold in reserve with only 2.2% in foreign reserves. Fortunately for the three countries, they may be purchasing gold at bargain of a price. The price of gold dropped by 40% from its peak in August 2011 at $1,900 an ounce.

Political Factor

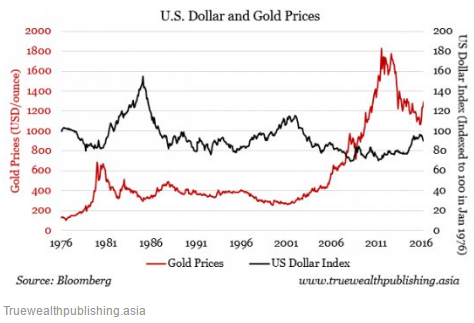

Government policies can affect the price of gold. The Federal Reserve set the interest rates banks can borrow. Interest rates are adjusted to control inflation. A higher interest rate would increase the value of the dollar, and if the value of the dollar increases, the price of gold will decrease. Businessinsider explains investors will buy more U.S. dollars if the Fed lifts interest rates. Unlike gold, the U.S. dollars pays interest after an interest rate hike. This would make investors demand U.S. dollars at the expense of gold price. The value of the U.S. dollar and price of gold are inverse. This means if the value of the dollar increases, the price of gold decreases. The price of gold is globally traded using the U.S. dollars. If investors or central banks purchase gold, they would use the U.S. dollars for the transaction. Purchasing gold would increase demand of the commodity, while the U.S. dollar would decrease in value. This is because in the transaction you are adding to the supply in circulation of the dollar. The less dollar in circulation, the more precious or value the currency has. A weak dollar compared to other world currencies would make gold more affordable to other currency holders, which could also result in greater demand for gold. Policies introduced by the government has the potential to affect gold prices and inflation. As the world watches the 2016 presidential election unfold between Democrat Hilary Clinton and Republican Donald Trump, many speculate a volatile gold market after hearing the election result. In a previous article by junior financial analyst, Yosef Cohen, shares whomever wins, domestic and international opinion will be met with distrust. This could potentially increase gold price as people would put more faith in gold instead of the US dollar.

Government policies can affect the price of gold. The Federal Reserve set the interest rates banks can borrow. Interest rates are adjusted to control inflation. A higher interest rate would increase the value of the dollar, and if the value of the dollar increases, the price of gold will decrease. Businessinsider explains investors will buy more U.S. dollars if the Fed lifts interest rates. Unlike gold, the U.S. dollars pays interest after an interest rate hike. This would make investors demand U.S. dollars at the expense of gold price. The value of the U.S. dollar and price of gold are inverse. This means if the value of the dollar increases, the price of gold decreases. The price of gold is globally traded using the U.S. dollars. If investors or central banks purchase gold, they would use the U.S. dollars for the transaction. Purchasing gold would increase demand of the commodity, while the U.S. dollar would decrease in value. This is because in the transaction you are adding to the supply in circulation of the dollar. The less dollar in circulation, the more precious or value the currency has. A weak dollar compared to other world currencies would make gold more affordable to other currency holders, which could also result in greater demand for gold. Policies introduced by the government has the potential to affect gold prices and inflation. As the world watches the 2016 presidential election unfold between Democrat Hilary Clinton and Republican Donald Trump, many speculate a volatile gold market after hearing the election result. In a previous article by junior financial analyst, Yosef Cohen, shares whomever wins, domestic and international opinion will be met with distrust. This could potentially increase gold price as people would put more faith in gold instead of the US dollar.

Bank Forecast

Given the economic outlook and political viewpoint of the United States and the world, banks are forecasting gold will increase in the year 2017, despite the recent downturn. Bank of America Merrill Lynch, Credit Sussie, and RBC Capital Markets have the highest projection of gold to rise up to $1,500 per ounce. That is a potential 20% upside in commodity price. ABN Amro speculates gold will be priced $1,450 by the end of 2017. UBS forecasts gold to be priced $1,400 range. Commerzbank sees gold to increase further given its expectations the Federal Reserve will not raise interest rate in the near future. Goldman Sachs considers $1250 as “a strategic buying opportunity.”

Conclusion:

We are maintaining a bullish forecast for gold. I Know First’s algorithm forecast the commodity as a long term investment.

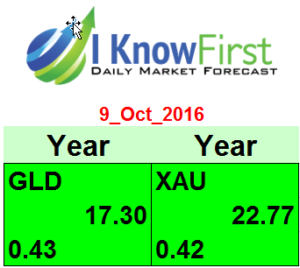

The forecast is color-coded, where green indicates a bullish signal while red indicates a bearish signal. Brighter greens signify that the algorithm is very bullish as it does at the top of this forecast. The signal is the number flush right in the middle of the box and the predicted direction (not a specific number or target price) for that asset, while the predictability is the historical correlation between the prediction and the actual market movements. Thus, the signal represents the forecasted strength of the prediction, while the predictability represents the level of confidence. The algorithm generates daily market predictions for stocks, commodities, ETF’s, interest rates, currencies, and world indices for the short, medium and long term time horizons.

Past I Know First Forecast Performance on GLD

In a recent forecast on June 3, 2016, the algorithm accurately forecast a bullish signal for GLD. In a 1 month time span, GLD rose by 11.01%, beating the S&P 500 return of -0.47%. This translates to a market premium of 11.48%. The chart below indicates, GLD’s stock performance since the start of the year. We have seen the price of GLD increase by 18.02%.

In another example, on October 15, 2015, the algorithm accurately forecast a bearish signal for GLD. In a 3 month time span, GLD decreased by 8.13%. Given both examples, the I Know First algorithm can be used for algo trading in this volatile commodity market to predict the future performance.

This bullish forecast on Gold sent to I Know First subscribers on June 3, 2016.