Gold Forecast: Are We Approaching a Golden Age?

Yosef Cohen is a Junior Financial Analyst at I Know First.

Yosef Cohen is a Junior Financial Analyst at I Know First.

Gold Forecast: Are we Approaching a Golden Age?

Summary

- Gold forecast at the beginning of 2016 were erringly bearish

- US and world market uncertainty is causing gold to rise

- Analysts have made new, bullish predictions for gold

- The US dollar is remaining stagnant which makes gold movements ambiguous

- The 2016 election gave have a large impact on gold prices

- I Know First maintains a bullish stance on gold

Gold’s Ambush

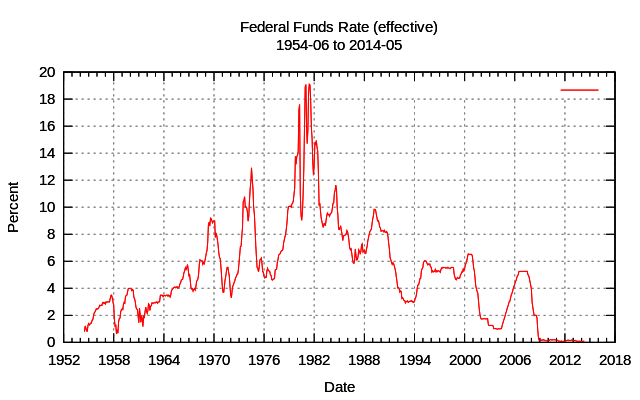

Throughout the year, gold prices were galvanizing contrary to analysts’ predictions. Gold is up about 23% from its price one year ago. Analysts were expecting the interest rates to increase which would make the economy and dollar stronger and gold weaker.

These speculations, of course, were never realized as the Fed decided to not raise interest rates this year. In addition, market volatility has increased gold prices in the past year. Brexit and China’s precarious economy have contributed to the rise of gold as well as negative interest rates abroad. Gold prices are based off of fear and distrust in the economy. A looming economic recession is another reason gold may rise. After the Great Recession, the price of gold reached its apex. This stems from consumers wanting a hard-asset that they value and them abandoning their non-backed currency. If economic stability becomes more dilapidated, gold prices will rise as a result.

Analysts Take Gold Seriously

Most analysts have rescinded their predictions for gold at the beginning of this year and announced new, higher predictions. UBS analysts believe gold will reach $1,400 before the end of the year. Bank of America analysts believe the expected value of gold is $1475 and will increase to $1500 in 2017. Credit Suisse believes gold will increase to $1500 as well. Swiss Asia Capital’s managing director believes gold prices will reach $1900 (its all-time high).

Many analysts have put their money where their mouths are and added gold to their portfolios. Well-known investors such as Bill Gross, Stanley Druckenmiller, Jeffrey Gundlach, and George Soros have all added the precious metal to their assets. Furthermore, central banks have amassed 45 metric tons of gold in the first quarter of this year alone. Even large countries such as China (35 metric tons in Q1), Russia (46 metric tons in Q1), and India (800 metric tons a year) are buying prodigious amounts of gold.

There are still analysts who believe gold has topped off and will start declining. A stagnant dollar won’t give any more ground for gold prices to increase. They also believe interest rates will increase eventually leading to declining gold prices. But many other signs point the other way, undermining many of these predictions.

Signs Point to Further Gold-Increases

Most of what increased the price of gold up until now is still continuing. Economies are further weakening throughout the world and fear is mounting. Brexit can lead to other countries leaving the EU which would hurt economies more. China’s export economy also has a limit until it crashes. Many believe another recession is also on the horizon which would see a crash in the stock market and a stark increase in gold prices. The Fed is also being pressured to not increase interest rates from 0.50% due to pressure from the stock market and weak job numbers. Foreign countries even have negative interest rates which favor gold incredibly. The 2016 presidential election can also be a major stimulus for the increase in gold prices.

2016 Election Gold

The upcoming election is a major cause of fear. Both Hillary Clinton and Donald Trump have been met with strong resistance from a lot of the American public. America will view the economy as more volatile and put less trust in the US regardless of who wins. This will likely increase gold prices to new yearly highs.

Hillary Clinton will likely continue President Obama’s policies which wouldn’t cause a massive increase in gold. The American public has labeled her as extremely untrustworthy though which can easily continue gold increases seen this year. Her presidency would continue the trend gold has been going through during this year.

Donald Trump, on the other hand, is an extreme wild-card in terms of his effect on the economy. His policies are shrouded in mystery though he will lean conservatively fiscally. This unknown effect he would have on the economy could cause a boom in the price of gold. His fiery rhetoric will also cause a lot of worry in dealing with other countries which would increase the price of gold due to uncertainty. It is unknown how Donald Trump would affect gold in the long-run, but his presidency will most likely begin with an increase in the price of gold to about $1850 an ounce by the end of 2017.

Gold prices have been effected by presidents before. Policies made by presidents affect inflation which have led to fluctuations in gold prices. Relationships with other countries also contribute to our economy and affect gold. A Donald Trump presidency can cause gold to skyrocket to nearly all-time highs while a Hillary Clinton presidency can still show continued support for gold investments.

I Know First’s Past Successes Predicting Gold Prices

I Know First is an Israeli Fintech company that created an algorithm to predict stocks, commodities, ETF’s, interest rates, currencies, and world indices for the short, medium and long-term time horizons. The I Know First algorithm is designed for large financial institutions, banks, and hedge funds in the capital market as well as private investors looking for an advanced algorithmic support system. The algorithm is currently tracking and predicting a growing universe of over 2,000 financial assets.

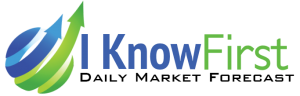

On May 13th, 2016, the I Know First algorithm gave a bullish signal strength of 12.06 and 11.20 for XAU and GLD with predictability indicators of 0.37 and 0.36. 3 months later, gold increased by 5.15% in accordance with the I Know First algorithm’s prediction.

Conclusion

While many analysts believed gold prices would decrease this year, gold is at two-year highs. There are still some analysts who believe gold prices have reached their peak and will start to wane once again.

Contrary to those predictions, gold has never looked so promising. With uncertainty in the world economy growing, gold prices are benefitted. Even within the United States fear bubbles as the elections loom and interest rates remain stagnant.

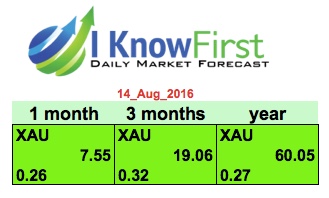

As you can see from the image below, my bullish stance on XAU and GLD are resonated by I Know First’s algorithmic signals.