Commodity Market Review: Coffee, Orange Juice, and Gold Prices Grow

Summary

- Coffee and orange juice markets influenced by currency fluctuations and weather conditions.

- Trade wars and expectations of the U.S. Federal Reserve lowering interest rates lead to increased demand for gold.

Coffee

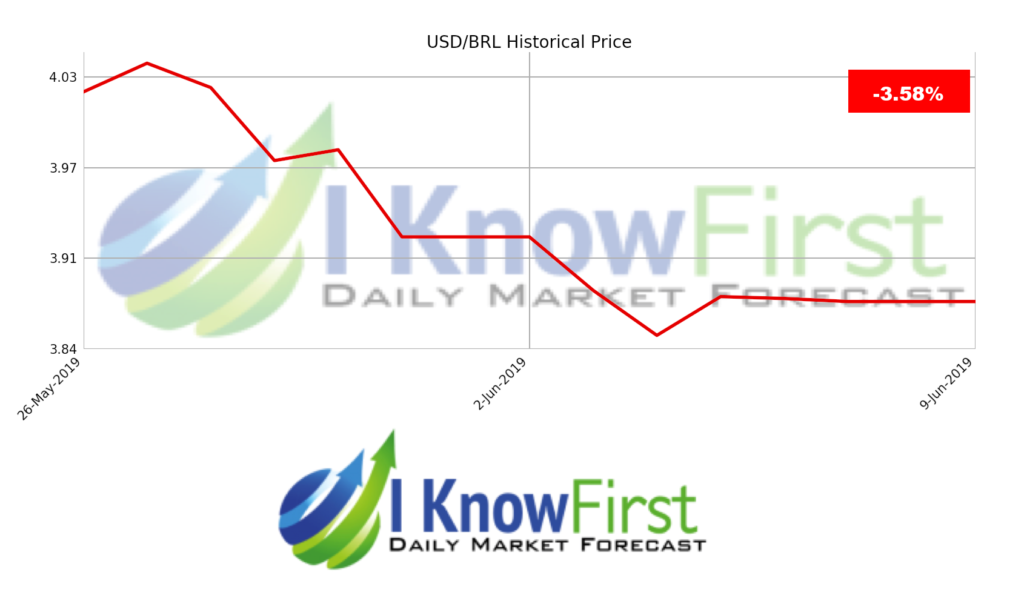

Brazil is the main producer of coffee beans, and the recent appreciation of the Brazilian Real has affected the value of coffee in USD. As the Brazilian Real Strengthens, coffee prices in the US increase because the US imports coffee from Brazil. In the last two weeks, the Brazilian Real appreciated against the US dollar with USD/BRL decreasing from 4.0223 on May 26 to 3.8779 on June 9, or a decrease of 3.58%. Over these two weeks, ICE_KC1 or coffee futures have increased 8.2%. Moreover, fears of frost that may harm coffee production in Brazil have also increased demand for coffee because traders fear future decreases in supply. As a result, I Know First was correct in predicting the upward trend of coffee.

The charts above illustrate that the price of coffee futures increases as the USD/BRL ratio decreases, which occurs when the BRL appreciates.

Orange Juice

As mentioned above, there is a strong correlation between the Brazilian Real and the value of Brazilian exports. Along with coffee, Brazil is also the leading global producer of orange juice. At the same time as the Brazilian Real appreciated from May 26 to June 9 with USD/BRL decreasing by 3.58%, orange juice increased by 5.10%. Like with coffee, orange prices in the US increase when the Brazilian Real strengthens because the US imports orange juice from Brazil. I Know First correctly selected ICE_OJ1 as a commodity with a bullish outlook.

Gold

Gold is a safe haven asset, or an asset expected to retain its value in a turbulent market. From May 31 to June 8, the market was exactly that with a continuing Chinese trade war and a potential tariff war with Mexico leading to fears of decreasing growth. Over this past week, gold increased by 2.64%. Furthermore, expectations of interest rate cuts by the Federal Reserve also increased the outlook for gold, because lower interest rates decrease the opportunity cost of holding gold, which carries no yield. I Know First was correct in forecasting a positive future for the gold commodity.

I Know First Forecast Performance

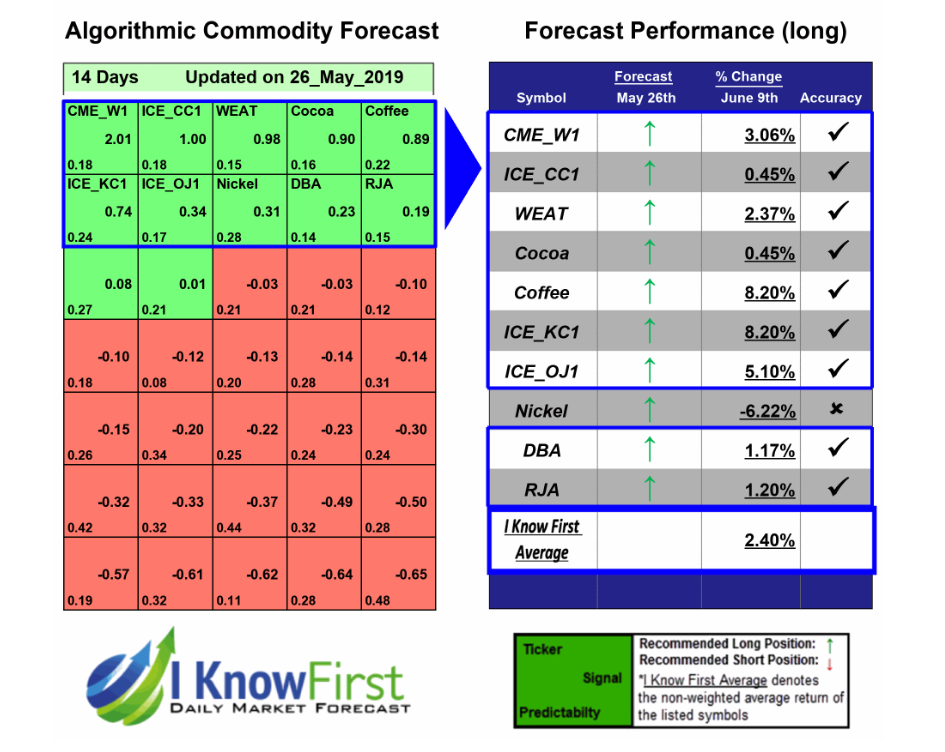

On May 26th, 2019 the I Know First algorithm issued bullish predictions for commodities for a 14 day time horizon. The predictions included ICE_KC1 (coffee futures), and ICE_OJ1 (orange juice futures) with a positive signal of ranging 0.74 for ICE_KC1 and 0.34 for ICE_OJ1, and with a predictability indicator of 0.24 for ICE_KC1 and .17 for ICE_OJ1. Over the 14 day trading period from 26th May to 9th June, ICE_KC1 gained 8.20% and ICE_OJ1 rose by 5.10%, in good agreement with the I Know First forecast. This bullish commodities forecast was sent to the current I Know First subscribers on 26th May, 2019.

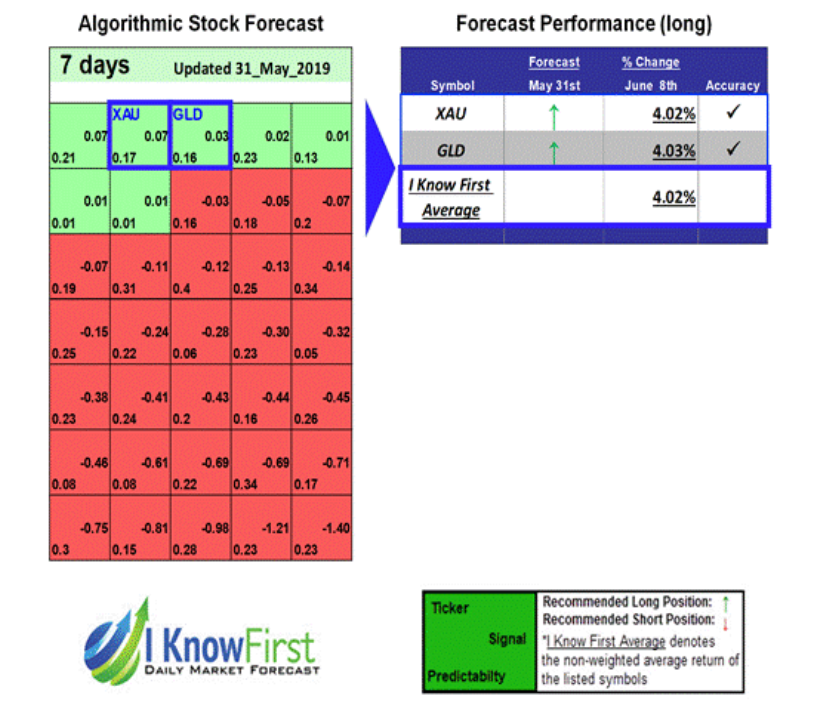

On May 31st, 2019 the I Know First algorithm issued bullish predictions for gold for a 7 day time horizon with a positive signal between 0.03 and 0.07, and with a predictability indicator between 0.16 and 0.17. Over the 7 day trading period from 31st May to 8th June, gold averaged a gain of 4.02%, in good agreement with the I Know First forecast. This bullish gold forecast was sent to the current I Know First subscribers on 31st May, 2019.

Algorithmic Stock Forecast: The table is a commodities forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 commodities in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant commodities have been included. The boxes are arranged according to their respective signal and predictability values (see the link for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position

Please note – for trading decisions, use the most recent forecast.Get today’s forecast and top commodities picks.