Commodities Market Review: Strengthening Auto Industry Sends Platinum Higher

Commodities Market Review: Strengthening Auto Industry Sends Platinum Higher

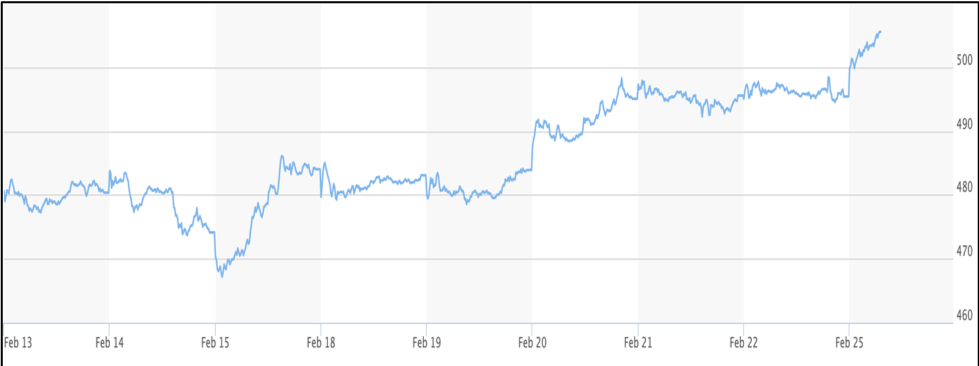

On February 15th, the price of Platinum hovered around 785 U.S. dollars per ounce. Over the past week, the price has steadily risen to over 850 dollars per ounce. Platinum is a precious metal that is commonly used for expensive jewelry, although it has other applications such as in the production of emission control systems for automobiles. These use cases should be considered when analyzing the price of Platinum, but the supply side should also be taken into account. Over 75% of the supply of Platinum comes from South Africa, and output changes can drastically affect global prices.

With that said, it seems clear that the recent surge in the price of Platinum is due to the rise of automobile stocks.

(Source: OANDA, February 25, 2019)

STOXX Europe 600 Automobiles and Parts Index

(Source: MarketWatch, February 25, 2019)

The STOXX Europe 600 Auto and Parts Index is a commonly used Index to gauge the automotive industry in Europe. As can be seen from the chart above, this index began to rise on February 15th with a simultaneous rise in Platinum prices. The price behavior of the Europe auto index and Platinum appear to be highly correlated in this instance.

Automotive Manufacturing Assembly Line

(Source: flickr)

The rise in Auto Industry stocks could in part be due to optimism about a worrying tariff battle between the European Union and the United States. In the event that President Trump doesn’t impose increased tariffs on automobiles imported to the U.S., the industry can expect to perform even better than now. Likewise, this could serve as a strong benefit to the price of Platinum. However, if Trump decides against easing these restrictions, the E.U. is likely to retaliate and could send both the Auto stocks and Platinum index lower.

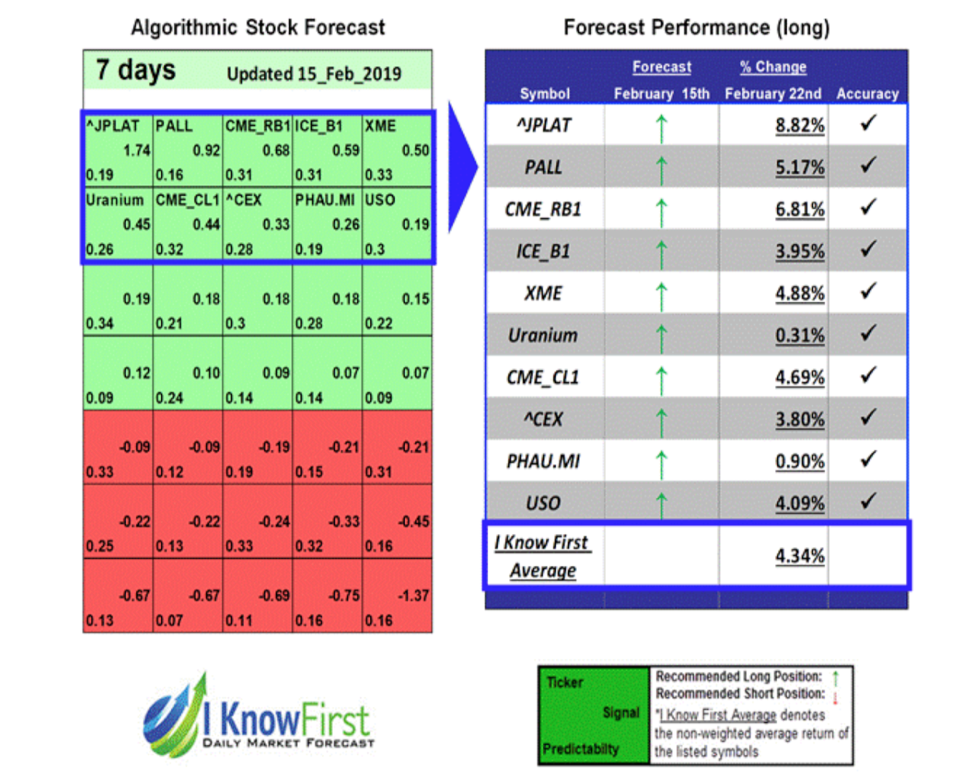

I Know First’s Successful Forecast

On February 15, 2019 I Know First’s algorithm issued bullish predictions for a 1-week time horizon. The predictions include ^JPLAT, an index for the metal Platinum. Over the 1-week trading period from February 15 to 22, Platinum prices rose by 8.82%.

This bullish commodity forecast was sent to the current I Know First Subscribers on February 15, 2019.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top commodities picks.