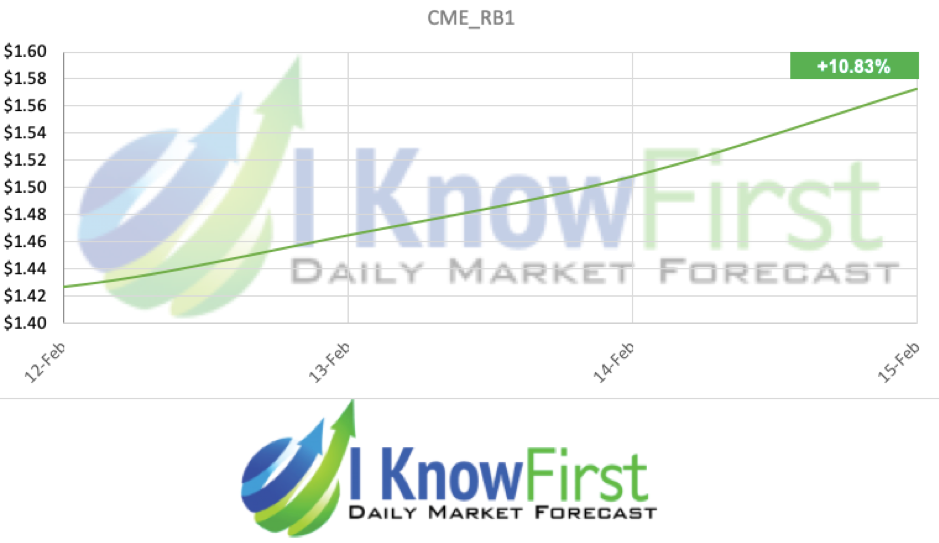

Commodity Market Review: Gasoline Rises 10.83% Led by Saudi Oilfield Closures

Commodity Market Review:

Summary:

- Gasoline prices are rising again this time hitting consumers at the pumps too.

- Brent Crude Oil (ICE_B1) futures rise +7.71% over the weekend.

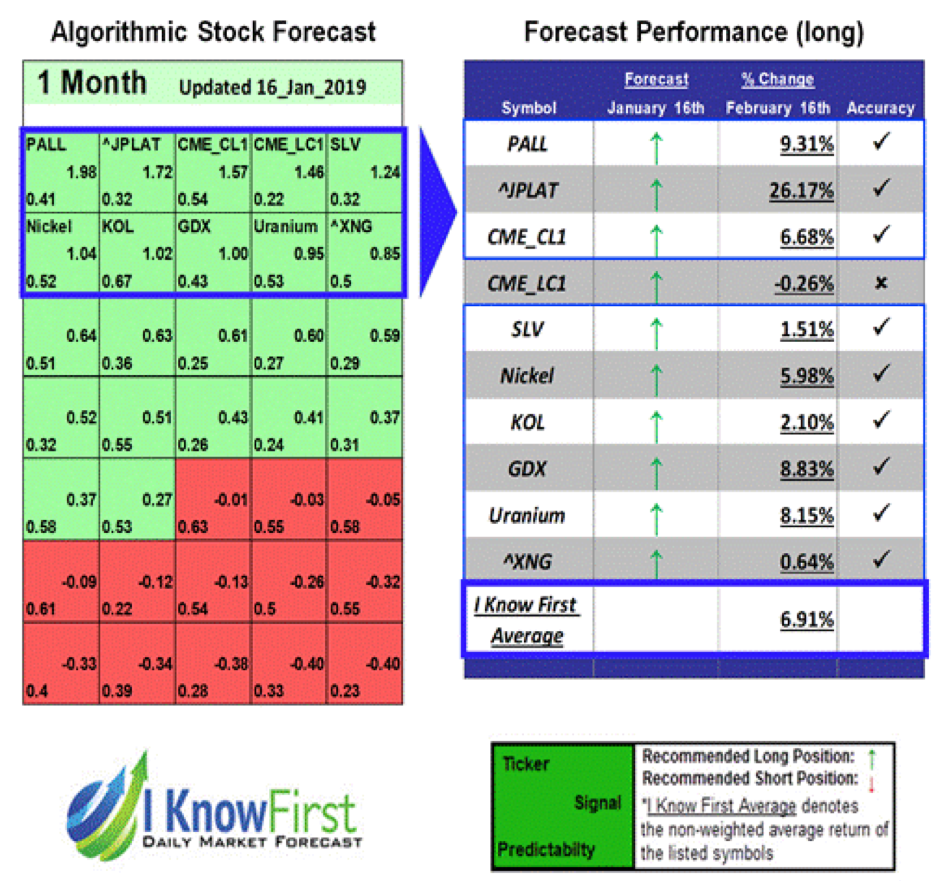

- Platinum (^JPLAT) has continued to rise for a month straight now with a 26.17% increase over the past month.

Gasoline futures (CME_RB1) rise 10.83% over the three day period from 12th February to the 15th February. Gasoline prices are rising again this time hitting consumers at the pumps too. The market concerns are largely reflected towards the international reaction to Venezuela and an increased set of sanction limiting the exports from the worlds former second largest exporter of Gasoline. However, investors’ concerns run deeper than the current drop of exports they are worried about the lack on investment in infrastructure within Venezuela and that the rising demands for gasoline and crude oil will not be met as yet another country looks to reduce its exports for the next decade or so with the lack of foreign investment into Venezuela and other OPEC countries that have similar issues.

Saudi Oilfield Closures Leads to A Rise in Brent Crude

Brent Crude Oil (ICE_B1) futures rise +7.71% over the same three-day period. Amid growing OPEC cuts to the exportation coupled with US sanctions on Iran it has led to a fall in the production of Crude Oil. Consequently, the market has seen a rise in Crude Oil prices. Prices were also buoyed by the partial closure of Saudi Arabia’s Safaniya, its largest offshore oilfield with a production capacity of more than 1 million bpd. The shutdown occurred about two weeks ago, a source said, and it was not immediately clear when the field would return to full capacity.

Demand for Platinum Rises For a fourth Successive Week

Platinum (^JPLAT) has continued to rise for a month straight now with a 26.17% increase over the past month. Palladium has a similar success of 9.31% both of these commodities where successfully predicted by the I Know First algorithm. The increased demands for catalytic convertors to reduce harmful emissions for engines drives the demand for this commodity.

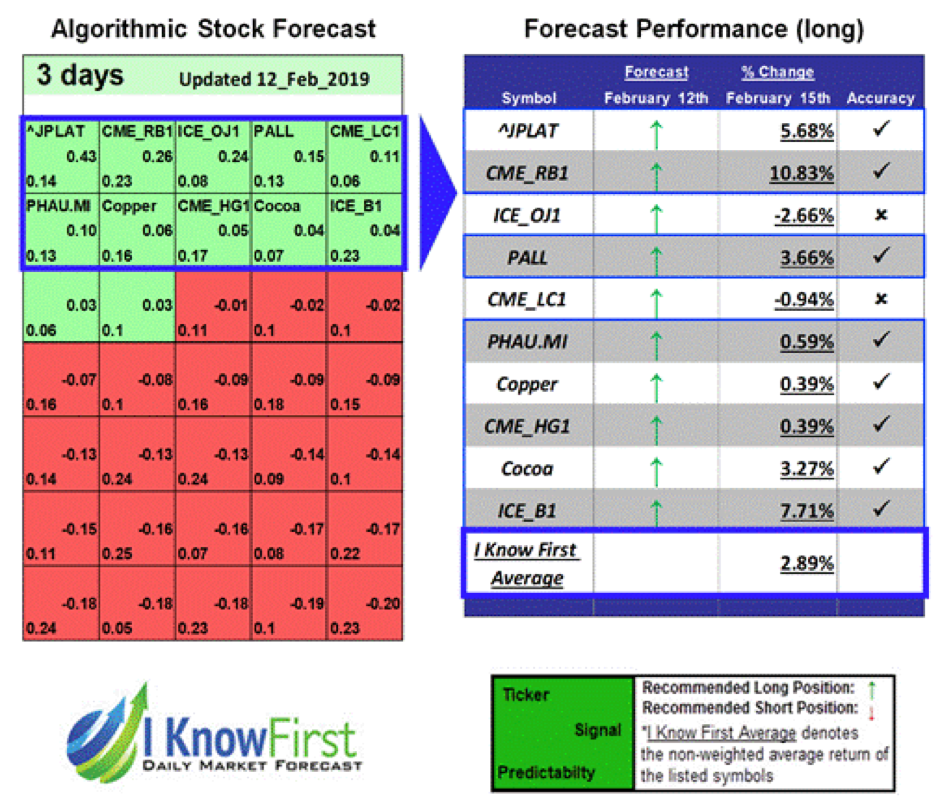

I Know First Successful Commodities Forecast

On 12th February and the 16th January I Know First algorithm issued bullish predictions for commodities for a 3-day and 30-day time horizon respectively. The predictions include Gasoline (CME_RB1) and Platinum (^JPLAT). Over the trading periods from, Gasoline and Platinum rose by 10.83% and 26.17% respectively.

How to interpret this diagram

These bullish Gasoline and Platinum forecasts were sent to the current I Know First subscribers on the 12th February and the 16th January respectively.

To learn how you can become a subscriber today, click here.

Please note-for trading decisions use the most recent forecast.