Commodity Market Review: Environmental Concerns A Big Commodity Price Driver

Summary:

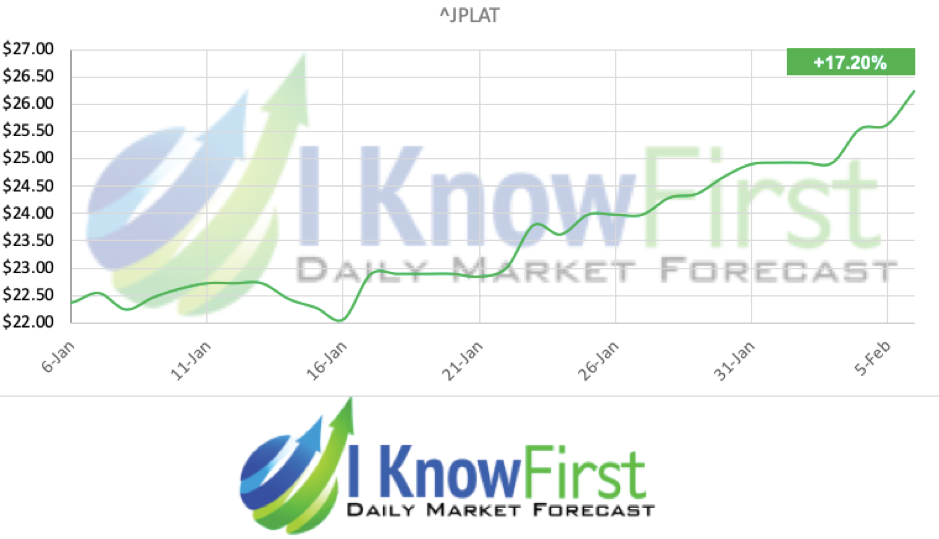

- Platinum (^JPLAT) sees a continued price increases of +17.20% over the past month.

- Sustainable energy production demands result in increased Uranium demand.

- Uranium rose by +9.23% over the month period from 6th Jan to 6th

Platinum (^JPLAT) sees a continued price increases of +17.20% over the past month 6th Jan to 6th Feb. Platinum stands out as being one of the most robust commodities to invest in with a strong return on Platinum investments over the past few months. This is due to the increased popularity car manufacturers have with Platinum and its use in exhausts to reduce harmful emissions. As battery operated cars are on the rise this reigned in the rise of Platinum however, the demand for non-battery cars is still increasing and Platinum seems to remain in demand.

Sustainable Energy Production Demands Result In Increased Uranium Demand

Another physical element that is traded is Uranium this rose by +9.23% over the month period from 6th Jan to 6th Feb. Uranium is the fuel that enables nuclear plants to generate electricity. Demand for the commodity is largely driven by global nuclear power output. Increased demand is primarily driven by countries like India and China, to contend with the dual-dilemma of massive electricity needs and increasing air pollution problems. Nuclear power provides just over 4% of electricity in China, leaving significant room for the nuclear energy sector in China to grow. Consequently, as China increases its use of Uranium the demand for this commodity is set to further increase.

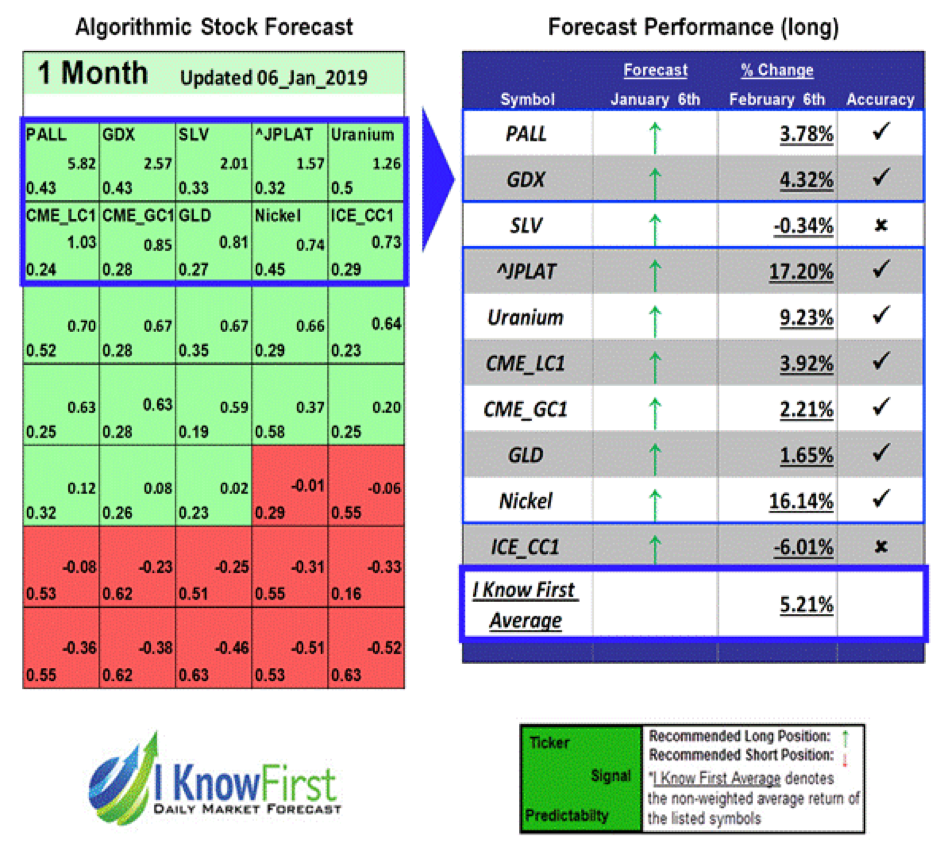

I Know First Successful Commodities Forecast

On 6th January I Know First algorithm issued bullish predictions for commodities for a 30-day time horizon. The predictions include Platinum (^JPLAT) and Uranium. Over the 30-Day trading period from 6th January to 6th February, Platinum and Uranium rose by 17.20% and 9.23% respectively.

These bullish Platinum and Uranium forecasts were sent to the current I Know First subscribers on 6th January.

To learn how you can become a subscriber today, click here.

Please note-for trading decisions use the most recent forecast.