Commodities Market Review: Crude Oil Prices Surge 6.29% Amid Venezuela Sanctions

Summary:

- Nickel up 6.62% with global demand growing for Nickel especially in China the market outlook for nickel remains strong.

- Crude Oil is up 6.29% in 3 days amid worries that supply from Venezuela is only set to further fall.

- Gold (GDX) is up 4.27% in 3 days from 27th January to 30th

Nickel up 6.62% in 7 days from the 24th January to 31st January. As seen in the graph below nickel demand is not only growing but the value of this commodity mirrors that of a precious metal. While one would not typically consider nickel a precious metal its use in the production of stainless-steel earmarks it as one of the more popular metals. Nickel is used as one of the alloying metals in stainless-steel and is used as one of the components for batteries. With global demand growing for Nickel especially in China the market outlook for nickel remains strong.

Crude Oil Prices Surge Amid Venezuela Sanctions

Crude Oil (CME_CL1) is up 6.29% in 3 days from 29th January to 1st February. This follows the announcement of both the US and the EU that they recognise opposition leader Guaidó as interim President. Consequently, supply from Venezuela is only set to further fall. Coupled with this are reports that OPEC members are set to reduce supply even further causing crude oil to surge over the past few days.

Gold Prices Continue to Rise In Face of Global Uncertainty

Gold Prices Continue to Rise In Face of Global Uncertainty

Gold (GDX) is up 4.27% in 3 days from 27th January to 30th January. Amid growing global uncertainty such as Brexit and a tense government presidential relationship in the US it comes as little surprise that investors are seeking refuge in gold.

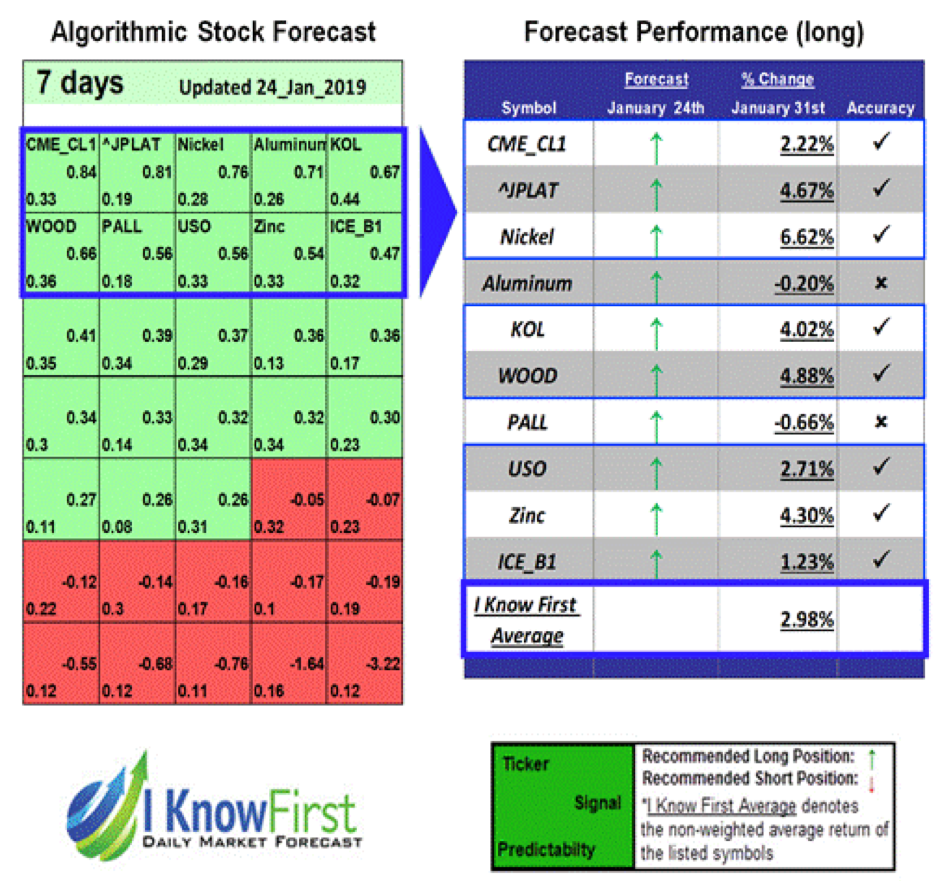

I Know First Successful Commodities Forecast

On January 24 I Know First algorithm issued bullish predictions for commodities for a 7-day time horizon. The predictions include Nickel and Crude Oil (CME_CL1). Over the 7-Day trading period from 24th January to 31st January, Nickel and Crude Oil rose by 6.62% and 2.22% respectively.

These bullish Platinum and Silver forecasts were sent to the current I Know First subscribers on January 24.

To learn how you can become a subscriber today, click here.

Please note-for trading decisions use the most recent forecast.