Commodities Market Review: Platinum Jumps 35.05% and Natural Gas Continues to Rise

Summary:

- Platinum (^JPLAT) rose by 35.50% over the past three months.

- Natural Gas (CME_NG1) rose by a whopping 49.04% over the past three months.

- As weather-related natural gas demand increased, relatively low levels of natural gas in storage likely contributed to price increases.

In this week’s forecast Platinum (^JPLAT) rose by 35.50% over the past three months. According to a report by the World Platinum Investment Council the 2019 forecast shows a market surplus of 455 koz, 10% lower than the surplus in 2018 due to a 1.6% increase in supply and a 2.4% increase in demand. 2019 demand growth will be driven mainly by chemical and petroleum demand reflecting economic growth, and a doubling in investment demand as a rebound in ETFs adds to robust bar and coin demand.

Platinum production involves mining of ore, production of concentrate, smelting of concentrate into ore, production of base minerals from a base metal refinery, and, finally, precious metals from a precious metal refinery.

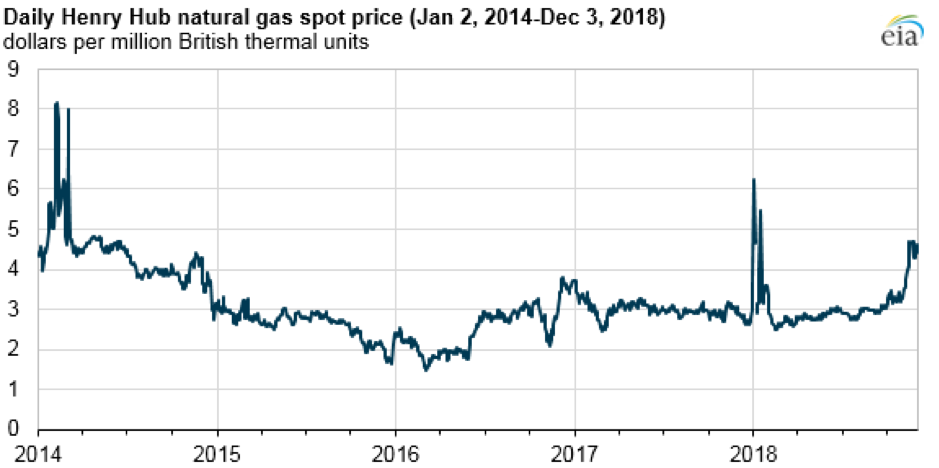

Continued low gas reserves continues to drive Natural Gas prices

Gas Price Hikes by Nick Youngson CC BY-SA 3.0 Alpha Stock Images

Gas Price Hikes by Nick Youngson CC BY-SA 3.0 Alpha Stock Images

Natural Gas (CME_NG1) rose by a whopping 49.04% over the past three months.

Natural gas (CME_NG1) is the primary space heating fuel in almost half of all U.S. households, and colder temperatures increase the consumption of natural gas for heating purposes. Data from the National Oceanic and Atmospheric Administration indicate that heating degree days (HDD) in November totalled 14% more than the 10-year (2008–2017) average for November. HDD are a temperature-based proxy for heating demand, and more HDD indicate colder temperatures. In the U.S. Midwest and Northeast, where heating demand is often the greatest, data indicate that HDD for November were 17% to 28% more than the 10-year average, respectively.

As weather-related natural gas demand increased, relatively low levels of natural gas in storage likely contributed to price increases. Natural gas inventories ended October at the lowest level since 2005. On November 23, U.S. inventories of natural gas were less than 3.1 trillion cubic feet, or 19% lower than the previous five-year average.

Source: U.S. Energy Information Administration, based on Thomson Reuters

Source: U.S. Energy Information Administration, based on Thomson Reuters

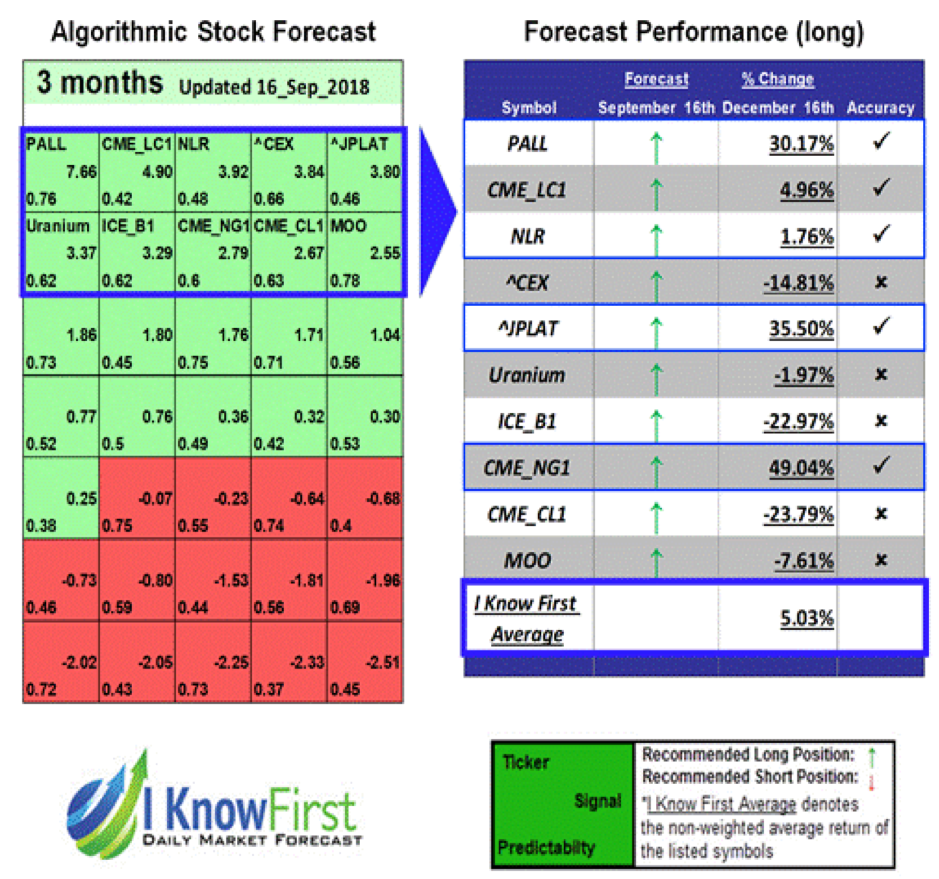

I Know First’s Successful Forecast

On September 16th I Know First algorithm issued bullish predictions for commodities for a 3-Month time horizon. The predictions include Natural Gas (CME_NG1) and Platinum (^JPLAT). Over the 3-Month trading period from September 16 to December 16, Natural Gas and Platinum rose by 49.04% and 35.50% respectively.

This bullish Platinum and Natural Gas forecasts were sent to the current I Know First subscribers on September 16th

To learn how you can become a subscriber today, click here.

Please note-for trading decisions use the most recent forecast.