Commodities Market Review: Natural Gas Rises by 31.97% Over the Past Fortnight

Commodities Market Review: Natural Gas Rises by 31.97% Over the Past Fortnight

Summary:

- Natural Gas Rises by 31.97% Over the Past Fortnight

- Gas Production struggles to keep up with demands

- Precious Metals: Palladium sees a 7.71% increase

- Past Forecast Success with I Know First

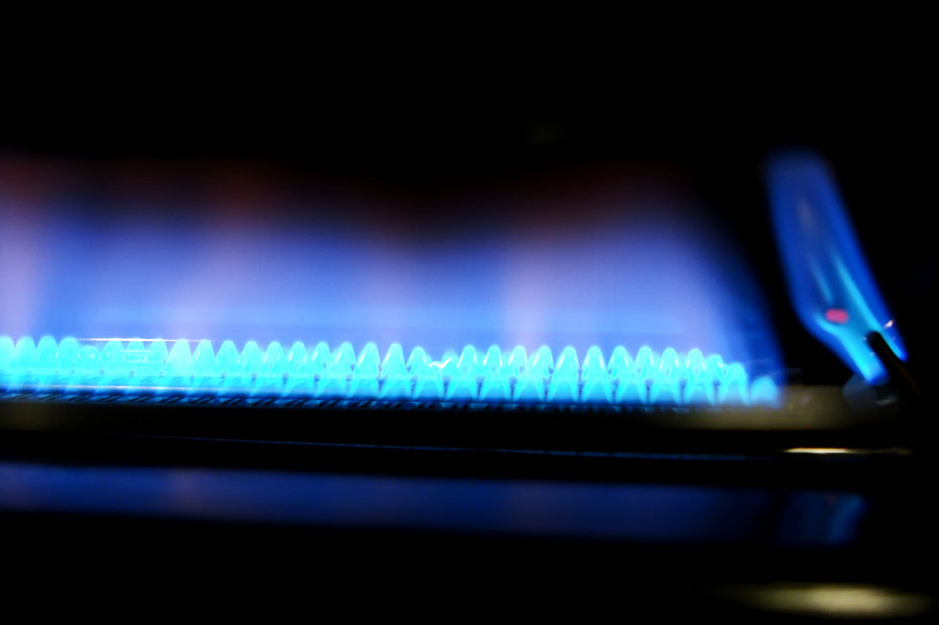

Natural Gas Rises by 31.97% Over the Past Fortnight

Source: Flicker

Source: Flicker

Natural Gas (CME_NG1) increases by 31.97% over the past two weeks. With temperatures reaching record lows, it’s perhaps no surprise that natural gas had one of its best fortnights in years. Its price popped almost 18 percent last Wednesday—before falling nearly as much on Thursday. The Energy Information Administration (EIA) reported that natural gas storage in the lower 48 states was below the five-year average as of October 31. This, combined with a stronger-than-expected start to winter, prompted traders to push prices to a four-year high of $4.84 per million British thermal units (MBtu). Meanwhile, natural gas futures trading hit an all-time daily volume record of 1.2 million contracts, according to CME Group.

Gas Production struggles to keep up with demands

In spite of reports that 2019 will be a year of record exports for Liquified Natural Gas (LNG) nonetheless short-term gas prices are still determined by how much sits in reserves available when the cold snap hits. A delayed start to the refill season led to storage levels that have remained lower than the previous five-year minimum. However, late-season injections during the past four weeks have been close to their five-year averages, with injections averaging 81 Bcf compared with the five-year average of 82 Bcf.

Precious Metals: Palladium sees a 7.71% increase

Source: Wikimedia

Source: Wikimedia

The major player in the palladium market is the auto industry. Nearly 80% of all palladium demand is from the global auto industry. Palladium is used in catalytic converters in gas-fuelled cars. It helps to reduce emissions from the car. Although electric cars use far less palladium (there may be some in the fuel cells, but not nearly as much as in catalytic converters). China’s push towards electric cars, while simultaneously eliminating subsidies on regular cars would point to lower demand for palladium. While this is only considering the demand of one country, it is a large part of the auto market and it could have an impact on the palladium prices in the future. However short-term demand for palladium remains strong.

I Know First Past Successful Forecast

On November 02, 2018 I Know First algorithm issued bullish predictions for commodities for a 14 day time horizon. The predictions include Natural Gas and Pallium. Over the 14 day trading period from November 02 to November 16, Natural Gas increased by 31.97% and Pallium by 7.71%.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top commodities picks.