Commodities Market Review: Natural Gas and Coffee See Biggest Gains Of 13.11%

Commodities Market Review: Natural Gas and Coffee See Biggest Gains Of 13.11%

Summary:

- Natural Gas Price Spike Amid Low Early Season Supply

- Lowest Gas Reserves in over 15 Years

- World Coffee Exports led by a 3.1% increase

- Past I Know First Algorithm Gas and Coffee Forecasts

Natural Gas Price Spike Amid Low Early Season Supply

Source: PEXELS

Source: PEXELS

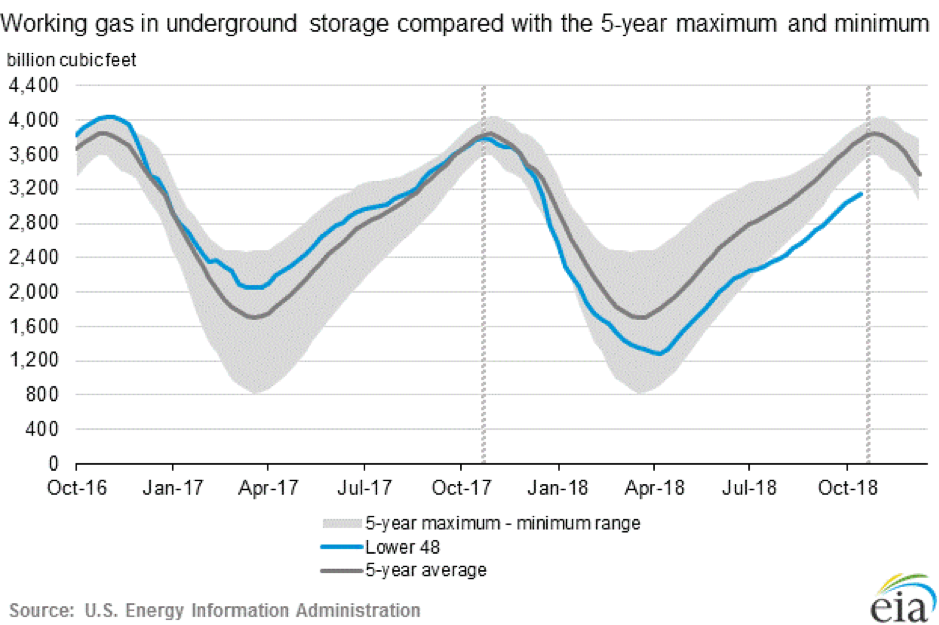

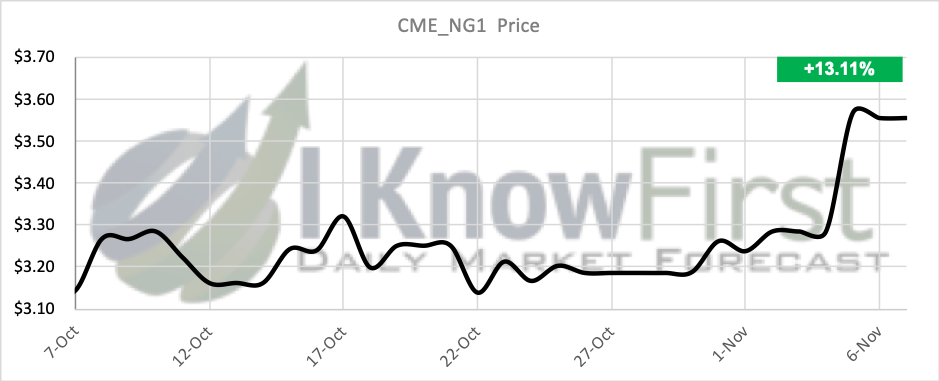

Natural Gas (CME_NG1) spikes at 13.11% over the past week. As forecasts for extended cold snaps in November the price of natural gas spikes at a time when early season supplies are at the lowest in over 15 years. Natural gas inventories stood at 3,143 billion cubic feet (Bcf) for the week ending on October 26, or about 623 Bcf lower than at this point last year and 638 Bcf below the five-year average. The graph below illustrates how natural gas inventories ebb and flow with the seasons – drawing down in the winter as households crank up the heat and rising again in warmer months as demand slows.

Lowest Gas Reserves in over 15 Years

Last year, as the injection season came to an end around this time, the total amount of natural gas in storage across the United States stood at 3.79 trillion cubic feet. Lingering cold temperatures in April 2018, the coldest April in the past 21 years, delayed the start of the natural gas storage refill season by about four weeks. Coupled with heavy natural gas withdrawals in January 2018, the delayed start to the refill season led to storage levels that have remained lower than the previous five-year minimum. However, late-season injections during the past four weeks have been close to their five-year averages, with injections averaging 81 Bcf compared with the five-year average of 82 Bcf.

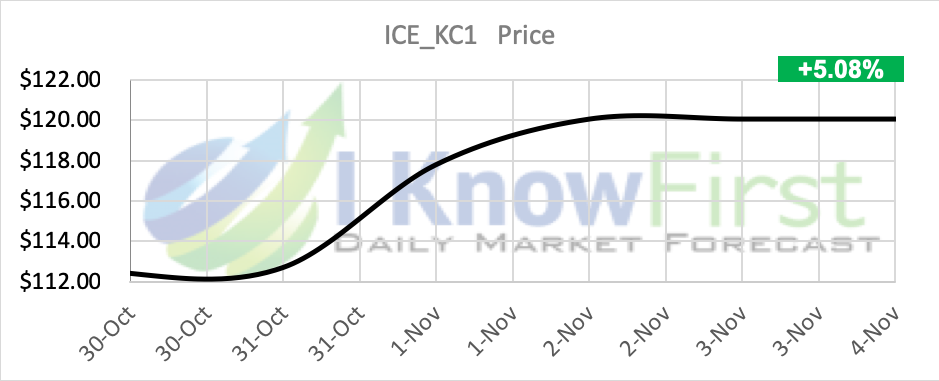

World Coffee Exports led by a 3.1% increase

Coffee (ICE_KC1) gains 5.08% over the past week. Coffee prices have seen a parabolic run-up in recent weeks as unprecedented hot and dry weather in Brazil has sucked the life out of what was expected to have been a record crop. World coffee exports amounted to 9.43 million bags in September 2018, compared with 8.75 million in September 2017. World coffee consumption is provisionally estimated at 161.93 million bags in coffee year 2017/18, led by an increase of 3.1 per cent to 35.9 million bags in Asia and Oceania’s consumption.

Source: Wikimedia

Source: Wikimedia

The Coffee C contract is the world benchmark for Arabica coffee. The contract prices physical delivery of exchange-grade green beans, from one of 20 countries of origin in a licensed warehouse to one of several ports in the U. S. and Europe, with stated premiums/discounts for ports and growths.

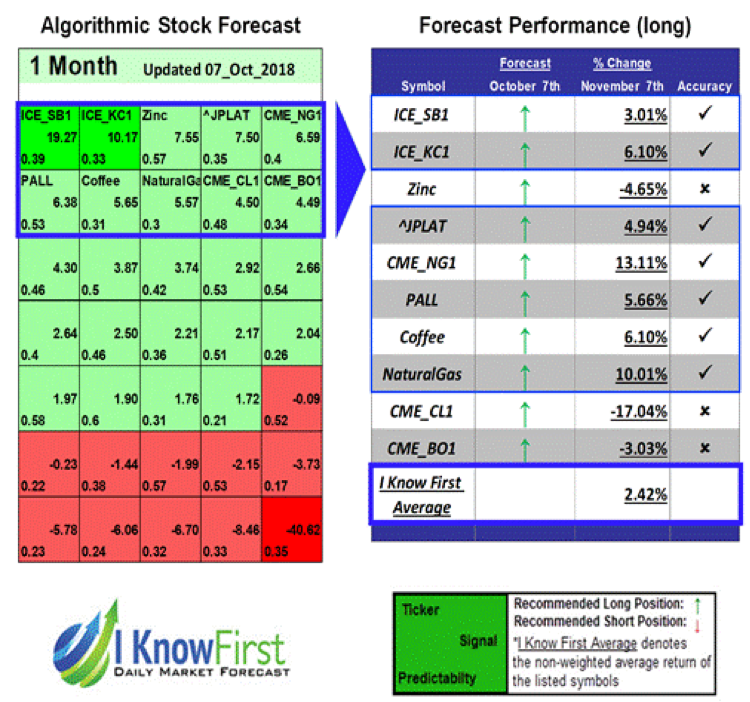

I Know First’s Past Successful Forecast for Natural Gas

On October 07, 2018 I Know First algorithm issued bullish predictions for commodities for a 1-Month time horizon. The predictions include Natural Gas. Over the 1-Month trading period from October 07 to November 07, Natural Gas raised by 13.11%.

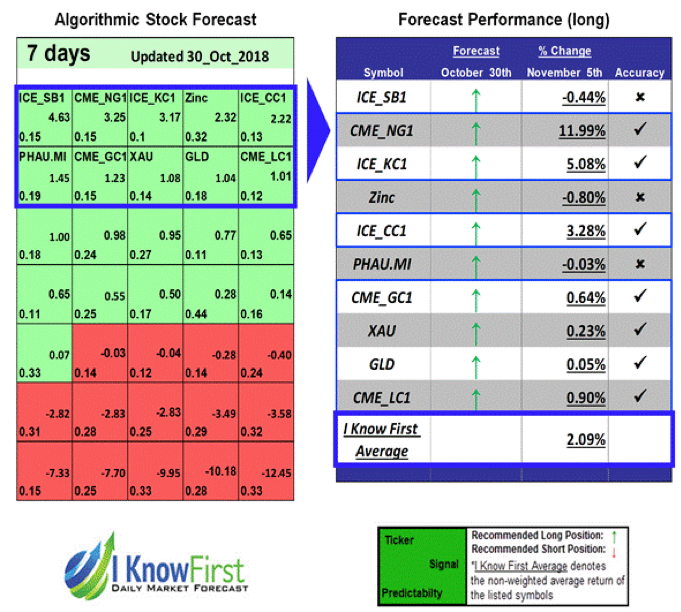

I Know First’s Past Successful Forecast for Coffee

On October 30, 2018 I Know First algorithm issued bullish predictions for commodities for a 7-Day time horizon. The predictions include Coffee. Over the 1-Month trading period from October 30 to November 05, Coffee futures raised by 5.08%.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top commodities picks.