Commodities Market Review: Labor Day Brought Gasoline Price to this Summer’s High

Precious Metals Trembled by Strong USD

During the past few months, precious metals were severely hammered by a surging USD on the foreign exchange market. Steep losses occurred to all of gold, silver, platinum and palladium. Gold sank to a 1.5-year low, silver a more than 2.5-year low, platinum a 14-year low and palladium a 13-month low. The hit on the precious metal market was mainly caused by the bearish effects of a strong USD, broad sell-offs and the prospects of diminishing demand amid the ongoing world trade war.

(Source: coreyegan.com)

On Aug 15, the USD climbed to a level never seen since July 2017 after U.S. retail sales smashed market expectations, increasing +0.5% during the month of July. Another contributor to the surge is the developing fears about a global currency market crisis after the further deteriorating relation between U.S. and Turkey, the two NATO allies. On that day, Turkey’s government slapped economic sanctions on U.S. as well, doubling tariffs on a number of U.S. products, raiding duties on American booze to 140 percent, cars to 120 percent and leaf tobacco to 60 percent. As a result, December gold futures were down $17.50 an ounce at $1,183.30 and September Comex silver was down $0.633 at $14.42 an ounce on that trading day.

Exhibit: USD Currency Index

(Source: tradingview.com)

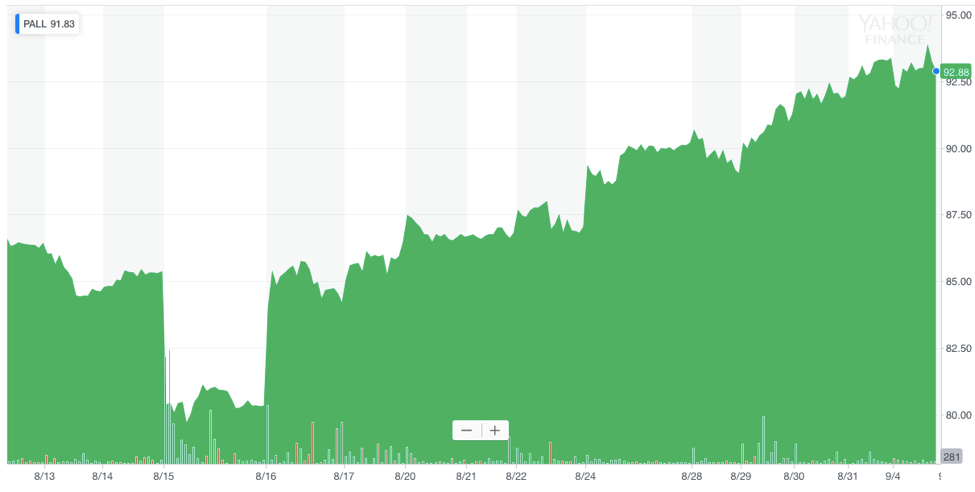

Palladium Fundamentally Stays Firm

Among all of the precious metals, palladium was hit most lightly, with only a 13-month low and a following significant rebound in the next two weeks. The prices are still higher compared with the levels last summer, thanks to a supply deficit and solid demand for this metal.

Exhibit: Price of PALL, a Palladium ETF

(Source: Yahoo Finance)

A “Platinum and Palladium Focus 2018” report was released by Metals Focus at the beginning of Platinum Week in London in the mid-year. According to the report, there has been a divergence between platinum and its sister metal palladium, both of which are materials for catalytic converters in automobile industry. The platinum market is largely balanced while palladium experienced a continuing shortage and hence gained a current $170 per ounce premium over platinum, the highest level since March 2001. It is stated by Metals Focus that the strong automotive demand forecast a new record high in 2018, rising 2% to 8.5 million ounces, due to its unique properties and critical importance in fighting against pollution. Citigroup Bank previously also stated that “the metal is forecast to be in a deficit of about 835,000 ounces this year”. Therefore, the fundamental advantages behind provide strong support for palladium’s price.

(Source: comparic.com)

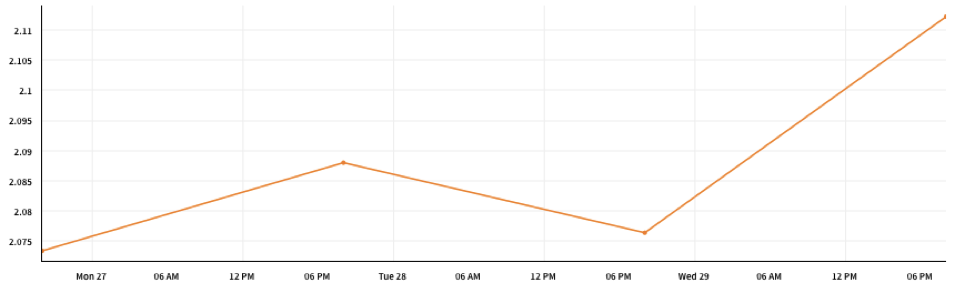

Gasoline’s Soar Supported by Rising Crude Oil

Ahead of the Labor Day holiday, gasoline prices are nearing the highest level since this May. Last Friday, September gasoline futures pushed over $2.15 per gallon, reaching the spike of this summer.

Exhibit: Price of CME_RB1, a Gasoline Futures Contract

(Source: Quandl.com)

The jump in price was primarily to capture the higher crude oil price that is being processed into gasoline in a historically high pace by U.S. refineries. According to Morgan Stanley’s report, Oil inventories fell 33 million barrels in the latest reporting period. The supply drop directly led to a surge in crude oil price last week and hence drove up gasoline price as well. In addition, the rise was also partly caused by the seriously damaged Iranian oil exports from U.S. sanctions.

(Source: usatoday.com)

Trading for $70 per barrel, crude oil reached a near two-month high last Friday. Based on data from the Energy Information Administration, U.S. average retail price for regular gasoline on Aug. 27 was $2.83 per gallon, the highest price on the Monday before Labor Day since 2014.

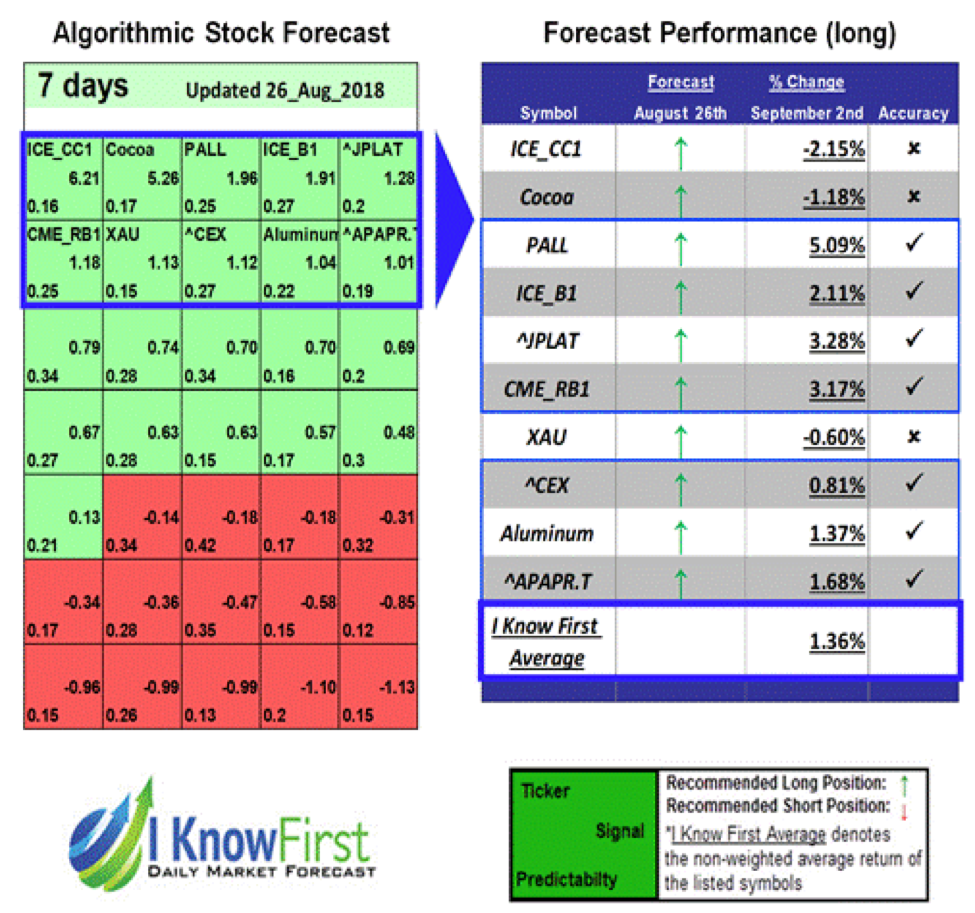

I Know First’s Successful Forecast

On August 26th, I Know First algorithm issued bullish predictions for commodities for a 7-day horizon. The predictions include PALL, a palladium ETF and CME_RB1, a continuous gasoline futures contract. Over the 7-day trading period from August 26 to September 2, PALL and CME_RB1 raised by 5.09% and 3.17% respectively.

This bullish commodity forecast was sent to the current I Know First Subscribers on August 26, 2018.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top commodities picks.