Commodities Market Review: Chinese Steel Soared on Restricted Output

Chinese Rebar Reached a 7-Year High

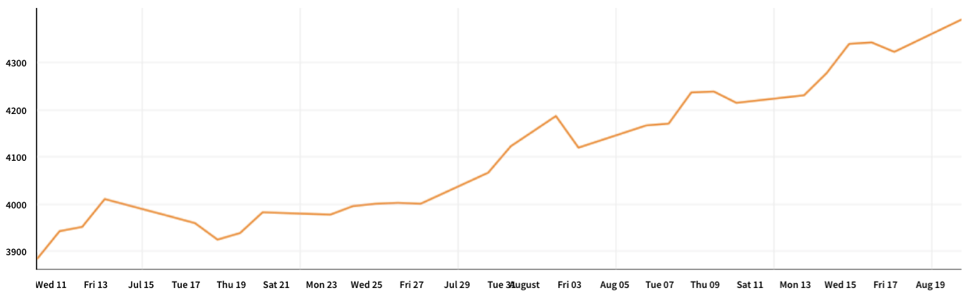

After the Trump administration announced the plan of slapping 10 percent tariffs on an extra $200 billion worth of Chinese imports, most of the Chinese commodities were depressed, including metals guided by copper, chemicals and crude oil. However, the steel market stayed robust, mainly supported by the Chinese anti-pollution campaign announced on July 10. On Aug 7, the Shanghai construction steel rebar surged to its highest in more than six years amid concerns over tight supplies due to a possible extension in winter production curbs in the northern part of the country. Later on Aug 20, its price further edged as much as 4.5 percent to a near seven-year high, driven by a new announcement of China’s top steelmaking city. The most-actively traded rebar on the Shanghai Futures Exchange hit 4,266 yuan ($624.20) a ton, its highest since April 2012. Spot rebar prices climbed 0.2 percent to 4,451 yuan on that day.

Exhibit: Price of SHFE_RB3

(Source: quandl.com)

Beijing’s Anti-Smog Campaign

On July 10, the thirteenth meeting of the National People’s Congress Standing Committee passed the resolution of strengthening the protection of ecological environment. To clear smog in 28 northern cities in the coming winter, Beijing issued a three-year anti-pollution action plan. With the government notice, steelmakers across the country are required to limit production from July 20 to August 31. The ultimate goal is to reduce the emission of air pollutants including SO2, NO2 and CO during the winter when homes crank up the heat and drive up the workload of coal-fired power plants.

Exhibit: Smog in Beijing

(Source: marketplace.org)

Winter Cuts Extension

Steel mills were prohibited from working during peak hours when power demand spikes. As China’s top steelmaking city, Tangshan was at first instructed to shut half of production capacity over summer season starting from July 20 and cut the pollutant density by 10-40% in the second half of this year. Besides, a stricter winter cuts will come on top of the production restrictions. On Aug 17, Tangshan said that it is adding two more months to its scheduled winter production cutting period starting mid-November to mid-March, advancing its restriction plan to Oct 1 and pushing until end of March. Guangxi province, another major steel maker, plans to extend the steel capacity reductions so that the average concentration of PM2.5 could be ideally cut 15 percent by 2020 compared to the level in 2015.

(Source: afr.com)

Although in a short term, the worries of tightened supply from extended steel production curbs period is expected to significantly impact the entire domestic steel market and support the positive trend of steel price.

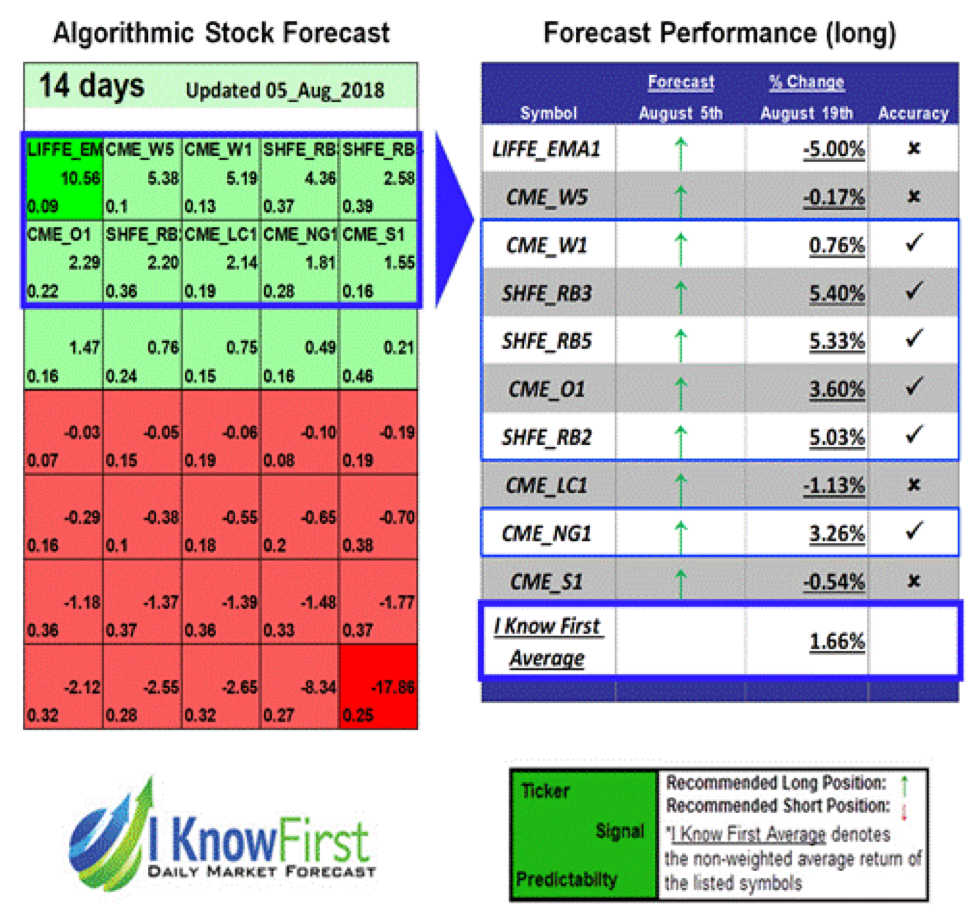

I Know First’s Successful Forecast

On August 5th, I Know First algorithm issued bullish predictions for commodities for a 3-day horizon. The predictions include SHFE_RB3 and SHFE_RB5, both continuous rebar futures contracts on Shanghai Futures Exchange. Over the 14-day trading period from August 5 to August 19, SHFE_RB3 and SHFE_RB5 raised by 5.4% and 5.33% respectively.

This bullish commodity forecast was sent to the current I Know First Subscribers on August 5, 2018.

How to interpret this diagram

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top commodities picks.