Gold and Commodities Market Review: Strong USD Led to the Failure of Gold’s Rebound

Gold and Commodities Market Review

(Source: Commodity Trade Mantra)

Sound US Economy Contained Precious Metal Price

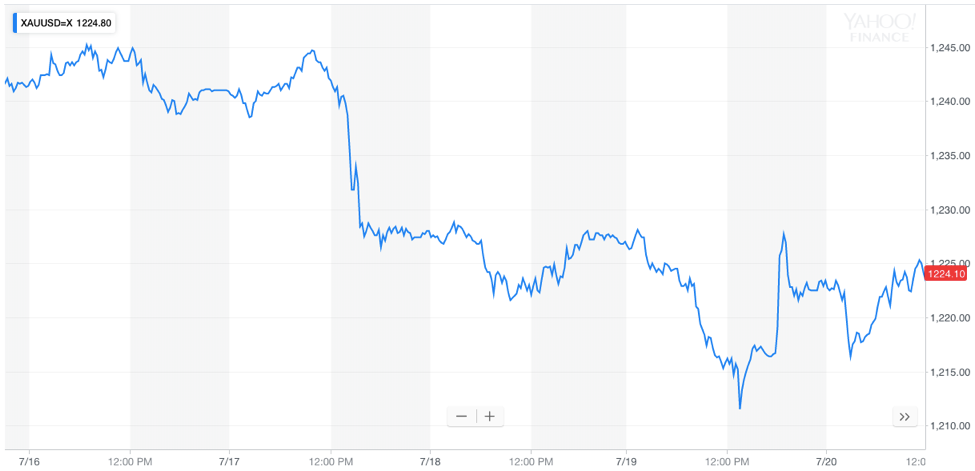

Gold market experienced another wave of selling pressure in the past week, mainly because of the bullish US economic outlook and stronger USD. Gold price dropped below $1230 per ounce last Tuesday immediately after the comments from Federal Reserve Chairman Jerome Powell. Later that Thursday upon the release of Philly Fed Manufacturing Index and unemployment claims, the precious metal further dipped into a new 12-month low, trading at $1211.5 per ounce. In the last three months, USD Index has risen 7% as it trades at a fresh 1-year high at 95.47 points. Meanwhile gold price has slid by nearly 10% in total.

(Source: Yahoo Finance)

During the testimony before the Senate Banking Committee last Tuesday, Fed Chair Jerome Powell expressed his bullish prospect for US economic performance with expectation of future steady growth. Despite uncertainty and potential downturn from trade dispute with China and Europe, the upbeat outlook came from various perspectives, including tight labor market, strong consumer spending and steady inflation rate. Although criticized by President Trump several days later, he announced the plan of further raising interest rate twice later this year, generating great headwinds for non-yielding bullion.

(Source: The National)

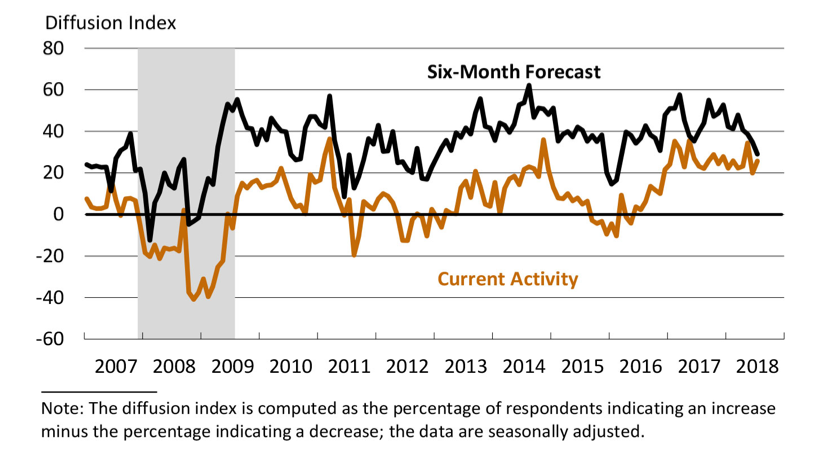

Later last Thursday, the July Philadelphia Federal Reserve survey data for the manufacturing industry was released. The report highlighted a significant jump in new orders to a reading of 31.4, up from 17.9 in June. Further, the index for current general activity jumped from 19.9 in June to 25.7 this month. The indicated robust expansion for the region’s manufacturing sector provided support for greenback.

Exhibit: Current and Future General Activity Indexes

(Source: philadelphiafed.org)

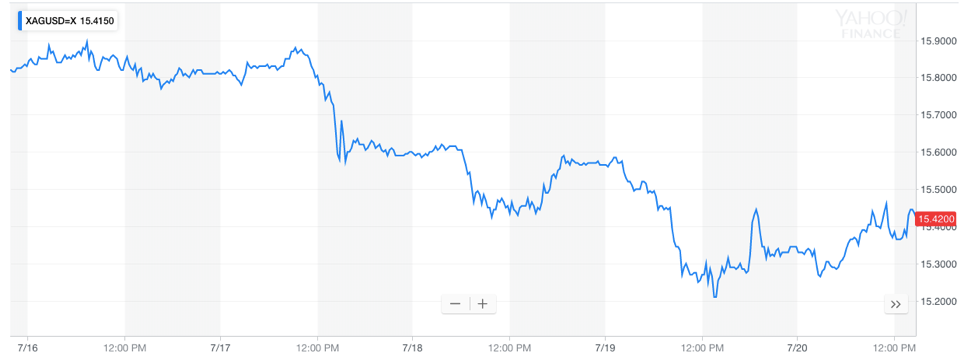

On the other hand, the weekly unemployment claims released on the same day shows a strong current labor market. According to the data provided by Labor Department, initial jobless claims fell another 8,000 to a seasonally adjusted 207,000 for the week ended July 14, the lowest since early December 1969. The figures reaffirmed Powell’s statement about the positive American job prospects and hence further gave confidence to the US market. As a direct result, gold became less attractive compared with U.S. Dollar and got a deeper sink on Thursday. Dropping to the weakest level since last July, silver suffered even more severely than gold. XAGUSD slid 1.31% last Thursday, closing at $15.29.

US Wheat Bounced off Thanks to Global Supply Shortage

CBOT Wheat futures rallied strongly and ended the past week with about 4% increase, reaching a near one-month high, mainly thanks to the expected fall of global crop yields suffered from various weather problems.

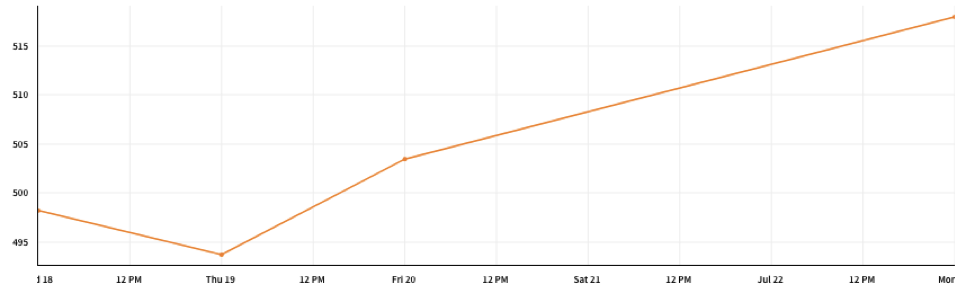

Exhibit: CME_W1 Price Chart

(Source: Quandl)

In Europe, crops were substantially hit by severe heatwaves and drought. While as Europe’s biggest wheat growers, France and Russia are facing a shift from dry to wet weather patterns and may be impacted by the excessive rain. On one hand, production is expected to be cut, especially in France and Germany. On the other hand, the wheat quality would be damaged as well. Meanwhile US spring wheat conditions were reported fairly well, with only 4 percent of the crop rated poor to very poor. Under the situation of tighten global wheat supply, demand for US wheat has been rising, pushing up the wheat price.

(Source: Agriland)

I Know First’s Successful Forecast

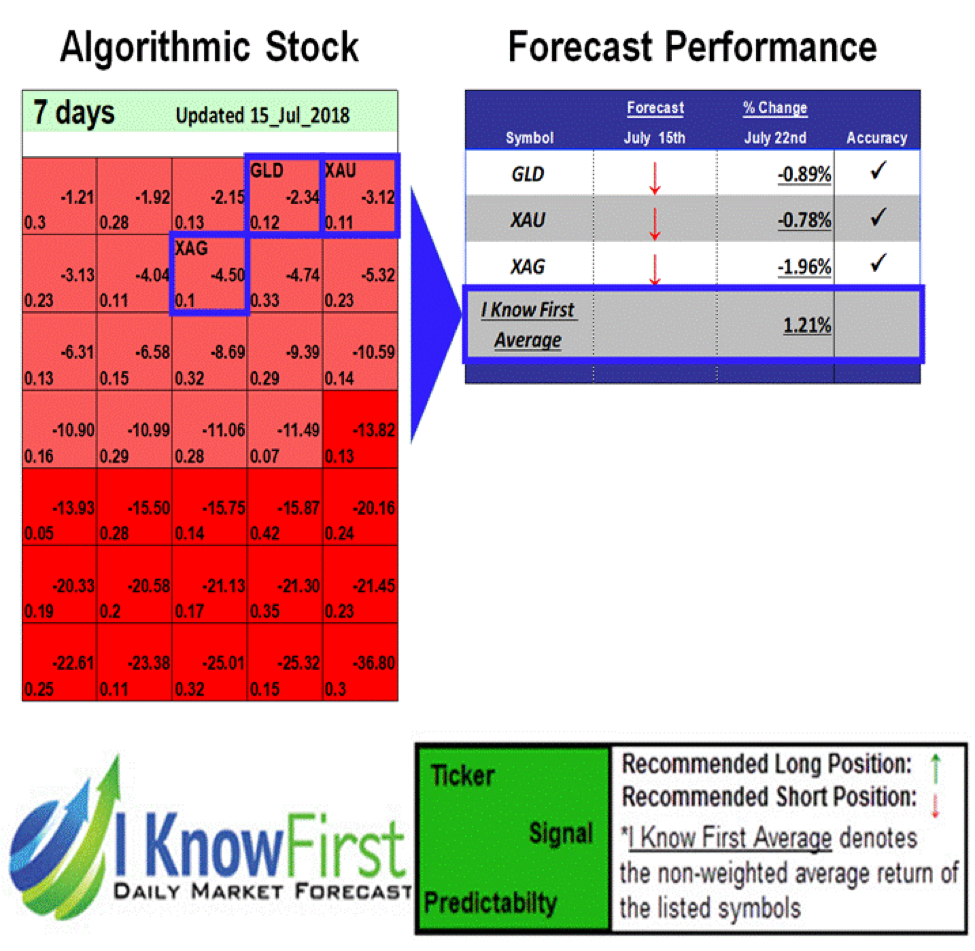

On July 15, I Know First algorithm issued bearish predictions for precious metals for a 7-day horizon. The predictions include XAG, commodity contracts for silver, GLD, a gold ETF and XAU, commodity contracts for gold. Over the 7-day trading period from July 15 to July 22, XAG dropped by 1.96%, GLD and XAU decreased by 0.89% and 0.78% respectively.

This bearish gold forecast was sent to the current I Know First Subscribers on July 15, 2018.

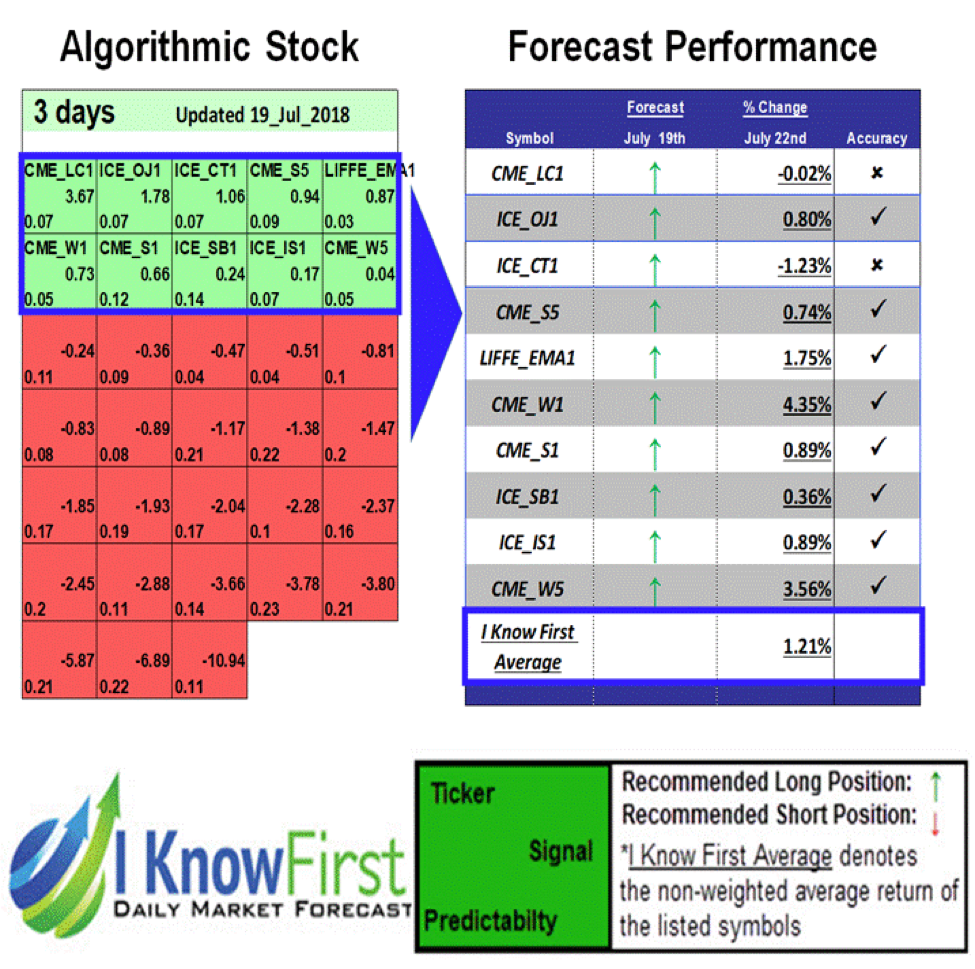

On July 19, I Know First algorithm issued bullish predictions for commodities for a 3-day horizon. The predictions include CME_W1 and CME_W5, both representing Wheat Futures Contract. Over the 3-day trading period from July 19 to July 22, CME_W1 rose by 4.35% and CME_W5 increased by 3.56%.

This bullish commodities forecast was sent to the current I Know First Subscribers on July 19, 2018.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top commodities picks.