Commodities Market Review: The First Victims in Wake of Trade War

As trade war is taking off, the global commodities market is the first to be directly hit. Despite rising price of other risky assets, the Dow Jones Commodity Index has decreased 5.37% in the past month. Among all segments, US cotton and Chinese steel market saw most significant rise due to macro statistics and political reasons respectively last week.

(Source: scmp.com)

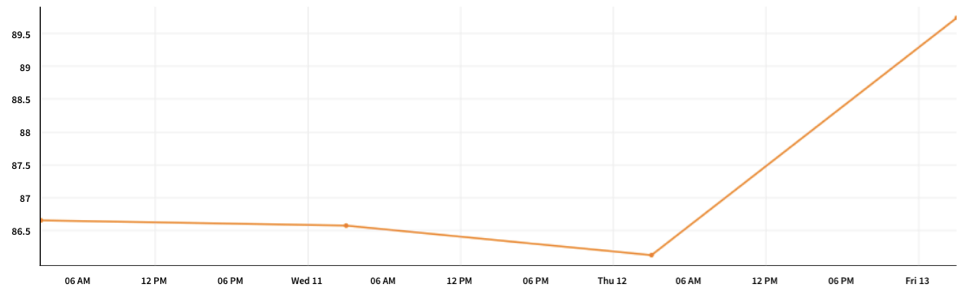

Cotton Jumped with Bullish USDA Report

Like other major US commodity exports, US cotton experienced a continuous depress since there were worries in mid-May about future trade war. However, there was a sharp rebound last Wednesday after the release of the July World Agricultural Supply and Demand Estimates (WASDE) report from the United States Department of Agriculture (USDA). On July 11, due to the bullish report, #2 cotton future contract price soared 4.20% to $89.75.

(Source: quandl.com)

The lift-up of cotton prices are mainly driven by the short supply position of seed cotton from USDA’s report data.

First, the report shows a 5.13% decrease in cotton production, from 19.5 million bales in June to 18.5 million in July, due to higher projected abandonment. The estimation also comes from the fact that the planted area increased but harvested area reduced because of the severe drought in Texas, the main crop-growing hub. Therefore, investors are pessimistic for both the amount and the quality of this year’s cotton production.

Second, 2018/19 ending stocks are estimated to be 4 million bales, 700,000 bales lower than last month, providing another support for cotton price.

Last but not least, global 2018/19 cotton consumption is 1.6 million bales higher than last month from revisions to consumption estimates for China, Bangladesh, Pakistan, Brazil and Vietnam. The change in consumption side added another motivator to price rise.

(Source: agweb.com)

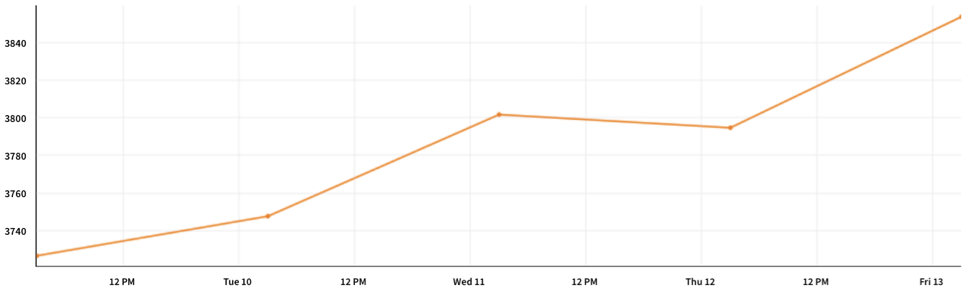

Chinese Rebar Reached a 10-Month High

After the Trump administration announced the plan of slapping 10 percent tariffs on an extra $200 billion worth of Chinese imports, most of the Chinese commodity markets were depressed, including metals following Dr. Copper, chemicals and crude oil. However, the steel market stayed robust, mainly supported by the official confirmation of the domestic pollution-control policies. The #5 rebar futures contract trading on Shanghai Futures Exchange climbed 2.83% to 3,854 yuan per tonne last Friday since the announcement of the policy.

(Source: quandl.com)

On July 10th, the thirteenth meeting of the National People’s Congress Standing Committee passed the resolution of strengthening the protection of ecological environment. With the government notice, steelmakers are required to limit production from July 20th to August 31st. The ultimate goal is to reduce the emission of air pollutants including SO2, NO2 and CO. As China’s top steelmaking city, Tangshan was instructed to cut the pollutant density by 10-40% in the second half of this year. Although in a short term, the worries of supply decrease became the biggest reason of the rise of steel price.

(Source: alibaba.com)

Oil Price Crashed from Libya’s Production Resumption

WTI crude experienced a 5.03% crash last Wednesday, July 11, the sharpest daily point drop in almost three years.

(Source: tradingview.com)

Multiple reasons contributed to the slide. One of the biggest push came from Libya’s sudden announcement of returning 700,000 barrels per day to the global market. The country said that it would lift the force majeure on several major export terminals and hence the full production is expected to resume. Another significant contributor was the comment from U.S. Secretary of State Mike Pompeo during an interview with Sky News Arabia. As opposed to last month’s threat of reducing imports from Iran to zero, America’s position seemed to be soften and possible waivers for the sanctions can be expected. In addition, the possible extra 10% tariff announced by the White House further tightened the tension between the two countries and hence hurt oil demand.

(Source: oilandgaspeople.com)

I Know First’s Successful Forecast

On July 12, I Know First algorithm issues bullish predictions for commodities for a 3-day horizon. The predictions include ICE_CT1, Cotton No.2 Futures, Continuous Contract #1, SHFE_RB5 and SHFE_RB3, Rebar Futures on Shanghai Futures Exchange. Over the 3-day trading period from July 12 to July 15, ICE_CT1 rose by 4.29%, SHFE_RB5 and SHFE_RB3 increased by 2.77% and 2.43% respectively.

This bullish commodities forecast was sent to the current I Know First Subscribers on July 12, 2018.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top commodities picks.