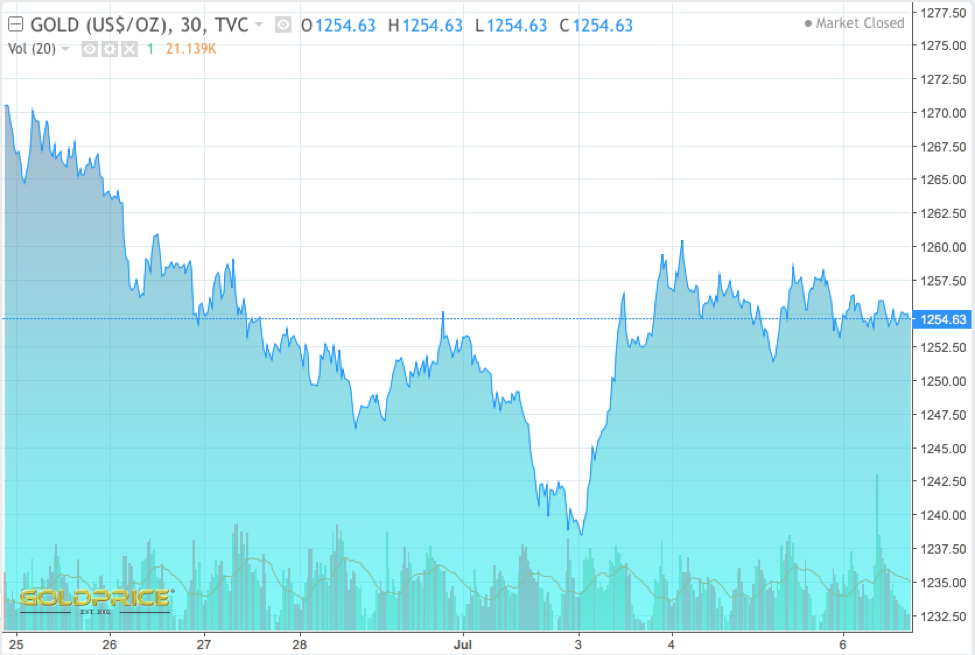

Gold Market Review: Yellow Metal Managing a Breath as USD Weakens

Last week USD was volatile due to the continuous release of U.S. economic data, FOMC meeting minutes and monthly jobs report. As a direct result, the dollar-denominated yellow metal was trembling as well.

(Source: goldprice.org)

Bullion Sank to New 2018 Low

On July 2, Monday, US manufacturing report on Business was released by the Institute for Supply Management’s (ISM), indicating a strong momentum in manufacturing sector. According to the data, June PMI rose 1.5% from 58.7 to 60.2, exceeding economists’ expectation of 58.2. The 22nd consecutive month of PMI growth signals accelerating manufacturing activities and America’s strong domestic economics that leads over the rest of the world. The robust ISM data provided firm support for USD’s further appreciation in speculation of a growing economy. US Dollar Index climbed over 95 on the same day and gold price fell accordingly.

(Source: tradingview.com)

Several political events also helped easing risk-aversion from the beginning of last week and hence resisted gold price from going up.

On July 1, German Interior Minister Horst Seehofer threatened to resign as minister and as CSU leader after accusing Chancellor Angela Merkel of failing to push through the CSU’s demands on border control at a recent EU summit. At the meeting on the following day, the two came to a compromise regarding the migrant management issues and Seehofer agreed to remain his ministerial role. The German political uncertainties were temporarily eliminated.

(Source: spiegel.de)

Last week, it was said that U.S. President Donald Trump has privately expressed a desire to quit the WTO, but that it was not a serious proposal. On July 1 after EU said U.S. automotive tariffs would hurt its own vehicle industry and prompt retaliation, Trump said that U.S. has “a big disadvantage with the WTO. And we’re not planning anything now, but if they don’t treat us properly, we’ll be doing something”. The comment denied the official plan to quit WTO at this stage, letting the market take a reassurance.

(Source: globalvillagespace.com)

Bottom-Out Later Last Week

Gold price rebounded from Tuesday last week, lift by various factors.

First of all, there was substantial amount of short covering positions in the gold market since it dipped to a new 2018 low level.

Secondly, it may be led by the weakening of US dollar, which hit a three-week low on Friday. US June Non-Farm Payrolls (NFP) data was released on Friday, showing a rising unemployement rate to 4% from an 18-year low of 3.8% in May and a wage growth lower than forecast. US dollar was therefore pressured by the unexpected negative US job data. In addition, as a closely watched signal of potential inflation, the wage growth dimmed the market expectations of a fourth interest rate rise this year. Normally higher interest rates would suppress gold price because the bonds yield increase will reduce the appeal of non-yielding bullion. Hence as market doesn’t expect a further interest rate rise, there is support for gold price.

Last but not least, as US began to collect tariffs on $34 billion worth of Chinese goods on Friday, the lingering trade tensions provided another support for the bullion as well.

(Source: myknowledgeresources.com)

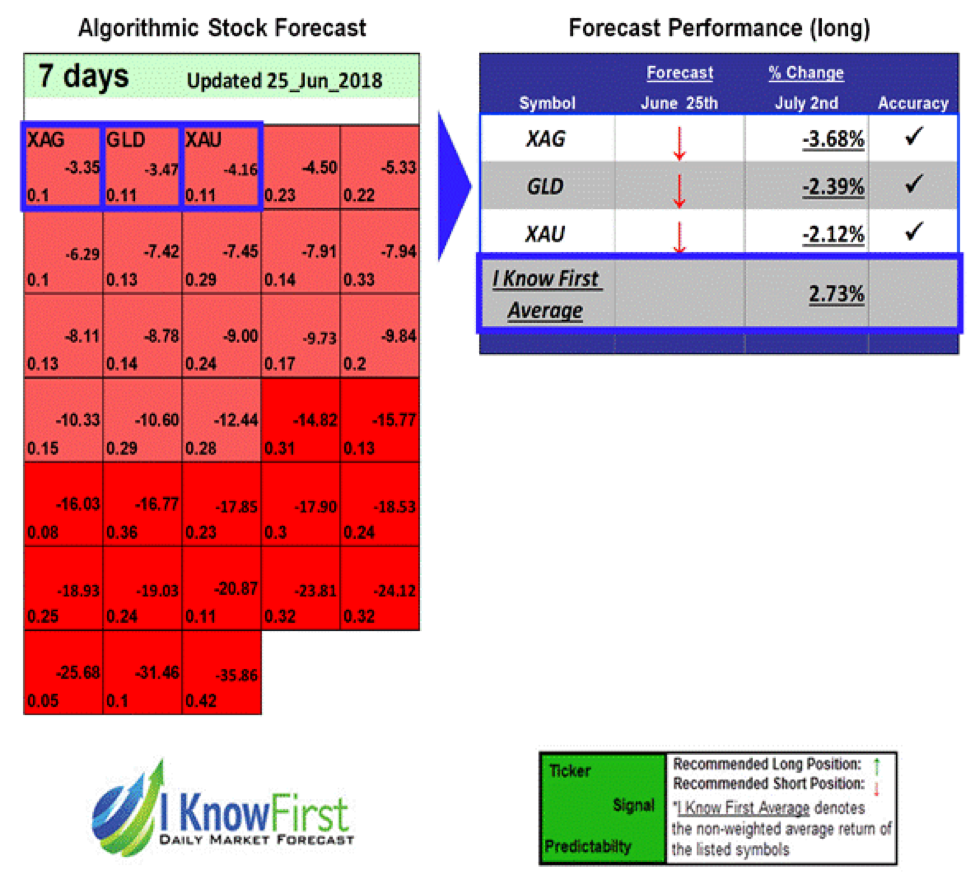

I Know First’s Successful Forecast

On June 25, I Know First algorithm issues bearish predictions for gold and other precious metals for a 7-day horizon. The predictions include XAG, a commodity denoting one troy ounce of silver, GLD, a gold ETF and XAU, a commodity denoting one troy ounce of gold. Over the 7-day trading period from June 25 to July 2, XAG decreased by 3.68% and GLD dropped by 2.39%.

This bullish commodities forecast was sent to the current I Know First Subscribers on June 25, 2018.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top commodities picks.