Gold Market Review: The Great Escape of Gold Holders

Gold Slid to a New 2018 Low

Despite concerns about the trade war between the U.S. and China, gold price didn’t act as the traditional safe haven this time and unexpectedly got a 0.56% setback over the past week. Its $1,267.20 per ounce closing price on Thursday reached the lowest since last December.

(Source: goldprice.org)

On the one hand, the rising demand caused by the heightened risk aversion in one single market may not be sufficient to lift up the price. On the other hand, Japanese Yen may be preferable serving also as a haven in turbulent times due to the much lower transaction costs required.

Downward Pressure against Stronger US Dollar

Because of the negative correlation between US dollar and gold price, the movements of US dollar can be a major driver and predictor of those of gold. Over the past few months, US Dollar has gained solid support from the overall positive short-term fundamentals of the U.S. economy, especially compared with Europe’s economic slowdown. On June 14, the US Dollar Index, measuring the value of US dollars against a basket of foreign currencies, made a jump and further rose to a seven-month high last Tuesday closing at 95.08.

(Source: Tradingview)

As a direct result, just like all other dollar-denominated commodities, gold becomes more expensive and hence less demanding for foreign investors.

Further Pushed by Rising US Interest Rates

The US Federal Reserve raised interest rates on June 13 and signaled two additional increases by the end of this year. The confidence Fed showed provided another strong support for US dollar by giving the market a positive prospect. In this context, the yellow metal would suffer from struggling to compete with yield-bearing assets. In other words, the global dollar assets will flow back to US when interest rate rises. Inflation level would be held down due to the decreased market liquidity. This tend to be bearish for gold, which is considered a good inflation-protecting tool.

(Source: Scottsdale Bullion and Coin)

Possible Rebound?

Last Thursday, US Dollar Index finally fell back under 95, creating a positive signal for future gold price movements. Combining with the fact that the risk aversion atmosphere has never faded away due to the trade war, gold price was not falling deeper since last Thursday. However, it’s still arguable whether this could be a rebounding opportunity for gold.

I Know First’s Successful Forecast

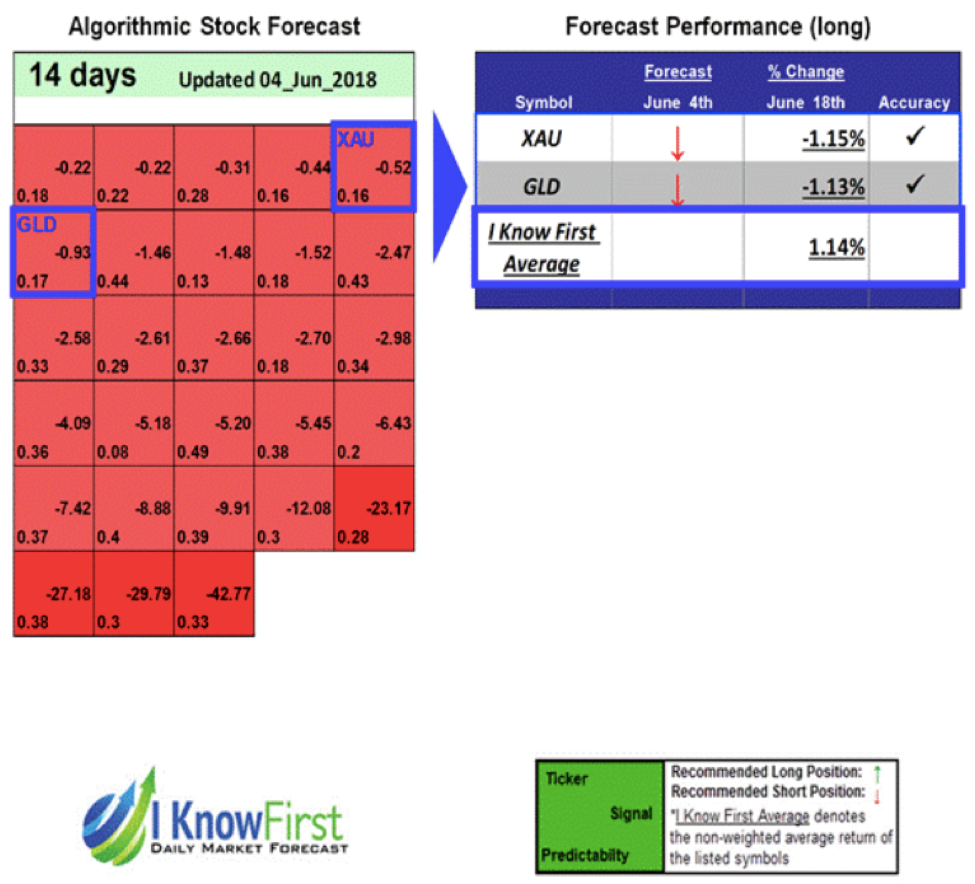

On June 4, I Know First algorithm recommended top 2 commodities for the short position, including XAU, an index of thirty precious metal mining companies that is traded on the Philadelphia Stock Exchange, and GLD, a ETF denoting a share of gold. Over the 14-day trading period from June 4 to June 18, XAU decreased by 1.15% and GLD fell by 1.13%.

This bullish commodities forecast was sent to the current I Know First Subscribers on June 4, 2018.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and top commodities picks.