I Know First Weekly Review: March 2nd, 2017

I Know First Weekly Review

On March 1st, 2017, our weekly newsletter was sent out to all our I Know First subscribers, which can be found here. Below, find the I Know First Weekly Review, highlighting the algorithm’s performance for this past week.

I Know First sends a weekly newsletter every Sunday to all the I Know First subscribers, highlighting the past week’s performance in all the covered financial markets, i.e. equity positions, currencies, and commodities. Additionally, the weekly newsletter includes analysis and updated news reports regarding prominent firms such as Apple, Yahoo, Baidu, and more which our subscribers are able to utilize for their investment strategies. The in-depth analysis is provided by the I Know First financial analysts, who are often times also top rated authors for prominent financial sites such as Seeking Alpha.

In general, the algorithm is based on Artificial Intelligence and Machine Learning with elements of Artificial Neural Networks and Genetic Algorithms incorporated in it. This means the algorithm creates, deletes, and modifies relationships between different financial assets to optimize its predictive accuracy. Based on the relationships and the latest market data, the algorithm calculates its forecasts. Since the algorithm learns from its previous forecasts and is continuously readjusting the relationships, it adapts quickly to changing market situations.

For a more detailed explanation, regarding the algorithm, click here.

As highlighted in the newsletter, our subscribers had seen superb returns, whether long-term or short-term. Our investors are able to tackle the market head on with all its recent uncertainties and achieve premiums well over those offered by institutional and classic fund managers. For example, on February 27, 2017, we published a 1-year long forecast article of our Commodities Package with a bullish signal for B1. Within 1 year 10 of the 10 predictions revealed themselves to be correct and B1 registered a return of 62.86%.

Every week the top performing financial instruments are highlighted, as shown below from this past week’s newsletter.

1. I Know First’s algorithm produced a year-long commodity price outlook based on data mining covering the month ending February 25. The package averaged a return of 36.74% with an accuracy rate of 100%. B1 was the top earner, bringing a 62.86% return to investors.

Package Name: Commodities

Recommended Positions: Long

Forecast Length: 1 Year (02/25/2016 – 02/25/2017)

I Know First Average: 36.74%

2. The three month commodities forecast based on I Know First’s self-learning algorithm showed a strong average return of 8.40% and an impressive 100% accuracy. The top performing commodity was XME, earning 16.29% for investors.

Package Name: Commodities

Recommended Positions: Commodities

Forecast Length: 3 Months (11/20/2016 – 02/20/2017)

I Know First Average: 8.40%

3. The month-long outlook for gold based on artificial intelligence showed a highest return of 3.88% from XAG with the package averaging 2.60%. The forecast showed a 100% accuracy rate for the algorithm.

Package Name: Gold Forecast

Forecast Length: 14 Days (02/10/2017 – 02/24/2017)

I Know First Average: 2.66%

4. This gold outlook showed 100% accuracy over the course of a month. The package brought in an average return of 2.50% for investors. The top earners were GLD and XAU, increasing by 2.50% over the course of the 30 days.

Package Name: Gold Forecast

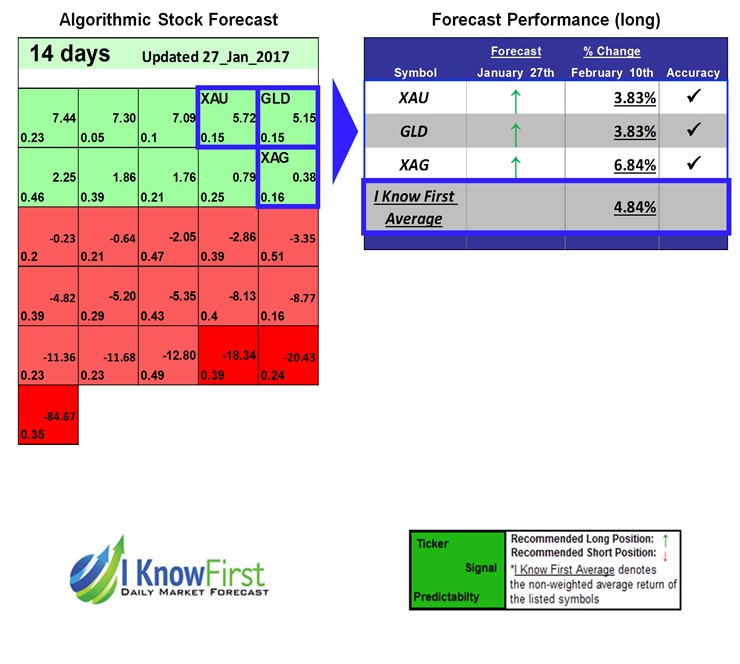

Forecast Length: 14 Days (01/27/2017 – 02/10/2017)

I Know First Average: 4.84%