Gold News: Gold Prices Down Amid an Expected Interest Rate Hike, a Strengthening Dollar, and the Upcoming Elections

Gold News

In the latest gold news: As of October 10, 2016 at 7:47AM EST, the price of gold dropped significantly down to $1261.01 per ounce. Around this time last week, gold was selling for approximately $1310 per ounce.

This magnanimous drop in the price of gold can be attributed to a few main factors. The first is the strong expectation that the Fed will raise interest rates in December, which in turn will decrease the value of gold investments. The strengthening dollar has also been negatively impacting the price of gold, as the dollar has hit its 2 month high. The looming US Presidential elections is another factor to be taken into account. With less than a month to go, tensions are running high. If Trump becomes the next president, gold prices will likely rise because of the uncertainty of what will happen to the US markets and gold being a safe-haven investment. While the polls are close, Hillary has now won both presidential debates, perhaps assuring some investors that Trump will not win and they may not need their safe haven investment.

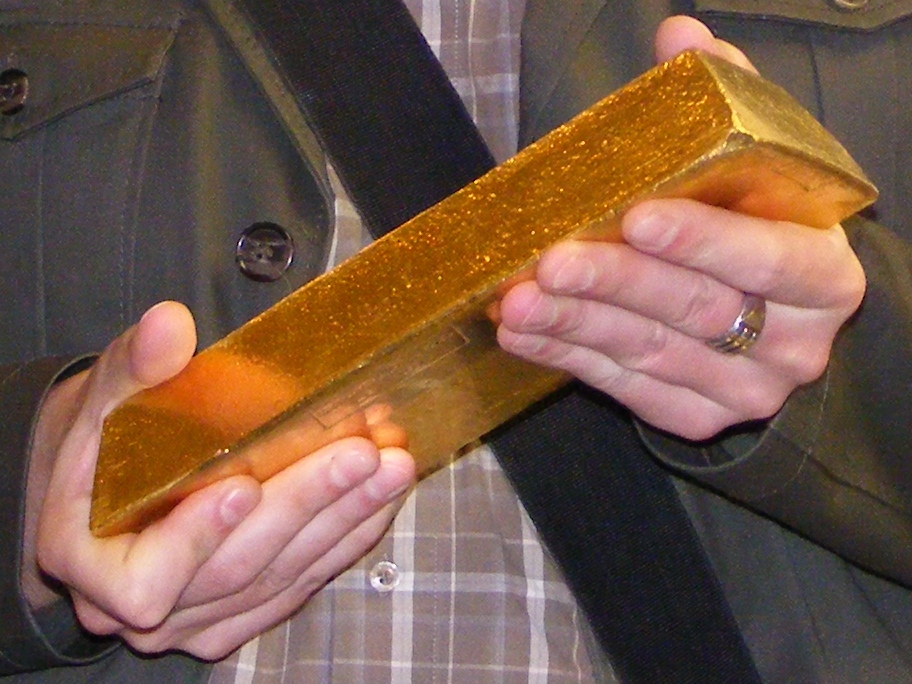

While many financial institutions are bearish on gold right now, Goldman Sachs is telling investors that if the price per ounce drops below $1250, then that is the time to invest in the precious metal. Goldman attributes the falling price to the expected interest rate hike at the end of the year. Goldman analysts say that despite this, gold is still in high demand from ETFs and there is still a strong demand for physical bars of gold. Goldman Sachs has even gone as far as referring to gold below the price of $1250 as “a strategic buying opportunity.”

On June 24th, I Know First’s algorithm accurately predicted that gold and silver would show negative growth in the 3-month gold prediction, as seen in “Gold Outlook Based on Genetic Algorithm: Over 14% in 90 Days.” I Know First’s average percent change came out to an impressive 9.04%.