Gold News: UBS Wealth Management Determines Ideal Selling Point for Gold

Gold News

Gold News: As bond yields fall and some countries have implemented negative interest rates, gold has increased by 19% this year, outperforming all other asset classes. In a column for CNBC, Wayne Gordon, commodity and currency strategist at UBS Wealth Management explained his outlook on gold.

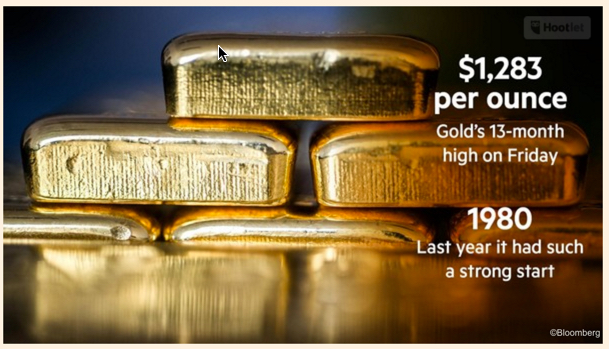

Gordon is waiting to see further U.S. economic, however, he currently believes that it is “too late to join the rally”. If U.S. economic shows improvement, Gordon believes that that Federal Reserve will normalize monetary policy sooner than expected. He explains that given the current market conditions, including interest rates, demand and central bank purchases all support a $1200 an ounce price for gold over the next six to 12 months. Gold hit a 13-month high at $1,283 an ounce on Friday, and Gordon believes that we should expect this to be around the peak.

(source: Bloomberg)

Gordon recommends that investors should sell gold as the price approaches $1,310 an ounce in the next weeks, and that investors should purchase more gold if prices fall back to $1,100 an ounce.