Gold News: Demand For Gold ETFs Increases at Fastest Rate in More Than A Year

Gold News

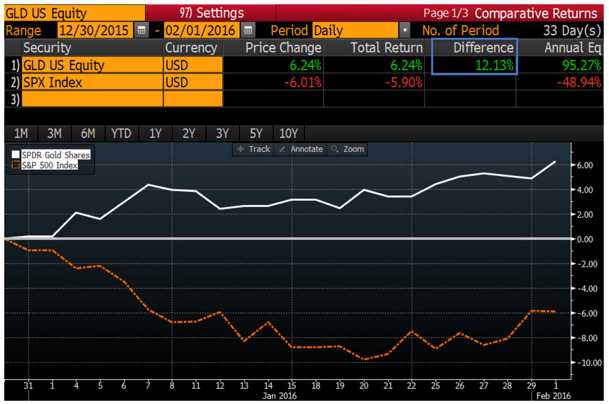

Whereas the S&P 500 has declined almost 6% for the year, the price of gold is up almost 6% this year. Bloomberg explains that gold ETFs were down 34% for the past 2 years, a trend that has been reversing. Since the start of 2016, $1.8 billion dollars have flowed into gold ETFs, as stocks and currencies have been extremely volatile.

(Source: www.bloomberg.com)

Many people flock to gold during times of fear, and gold ETFs give investors a chance to easily invest in the commodity. Among gold ETFs the most popular are SPDR Gold Shares (GLD) and iShares Gold Trust (IAU). With about $24.6 billion, GLD is attractive due to the fact that it trades over 500 million shares a day, providing investors with plenty liquidity, however it charges 0.40% annual fees. Investors who are more interested in holding onto gold may be more attracted to IAU which has about $6 billion, and only charges 0.25% in annual fees.

Bloomberg further explains that those investors who are really worried about the stability of the U.S banking system may want to invest in gold ETFs that store gold in other countries. Unlike the IAU and GLD which have gold vaults in the US, London and Toronto, some investors may feel more comfortable with Physical Swiss Gold Shares (SGOL), which stores its gold in Switzerland. SGOL investors value the reputation that Zurich has for safe keeping capital. This year, about $11 million dollars has flowed into SGOL.

Finally, there is another interesting Gold ETF, the Van Eck Merk Gold Trust (OUNZ), which has been consistently growing since 2014. OUNZ is unique because it when investors sell their shares, they will receive a delivery of physical gold. This is the only gold ETF, that does this, and it is also attractive because if investors are not taxed physical delivery of the physical delivery of gold that they receive.

Bloomberg analyst, Eric Balchunas, explains that watching the growth of these gold ETFs in the coming months is a good indicator of how much fear there is in the financial markets.